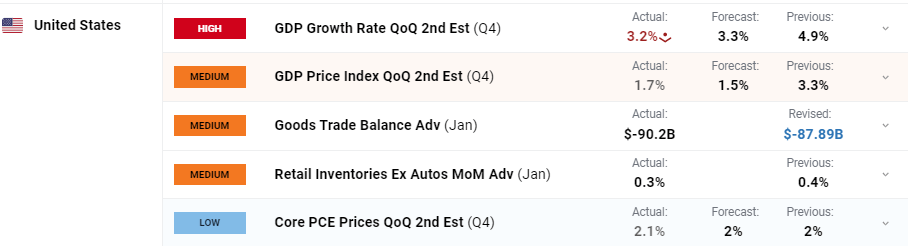

US Dollar and Gold Analysis and Prices

- The US economy remained robust in Q4 2023.

- The US dollar drifted lower post-release, gold nudged higher.

The US economy expanded by a robust 3.2% in Q4, the second estimate showed today, missing market forecasts of 3.3%. While the current Q$ estimate is lower than the strong 4.9% seen in Q3, the US economy remains in a very solid position and underpins the Fed’s current position of keeping rates at their current levels for longer in order to bring inflation sustainably back to target.

According to the US Bureau of Economic Analysis,

‘The increase inreal GDPreflected increases in consumer spending, exports, state and local government spending, non-residential fixed investment, federal government spending, and residential fixed investment that were partly offset by a decrease in private inventory investment. Imports, which are a subtraction in the calculation of GDP, increased.’

For all economic data releases and events see the DailyFX Economic Calendar

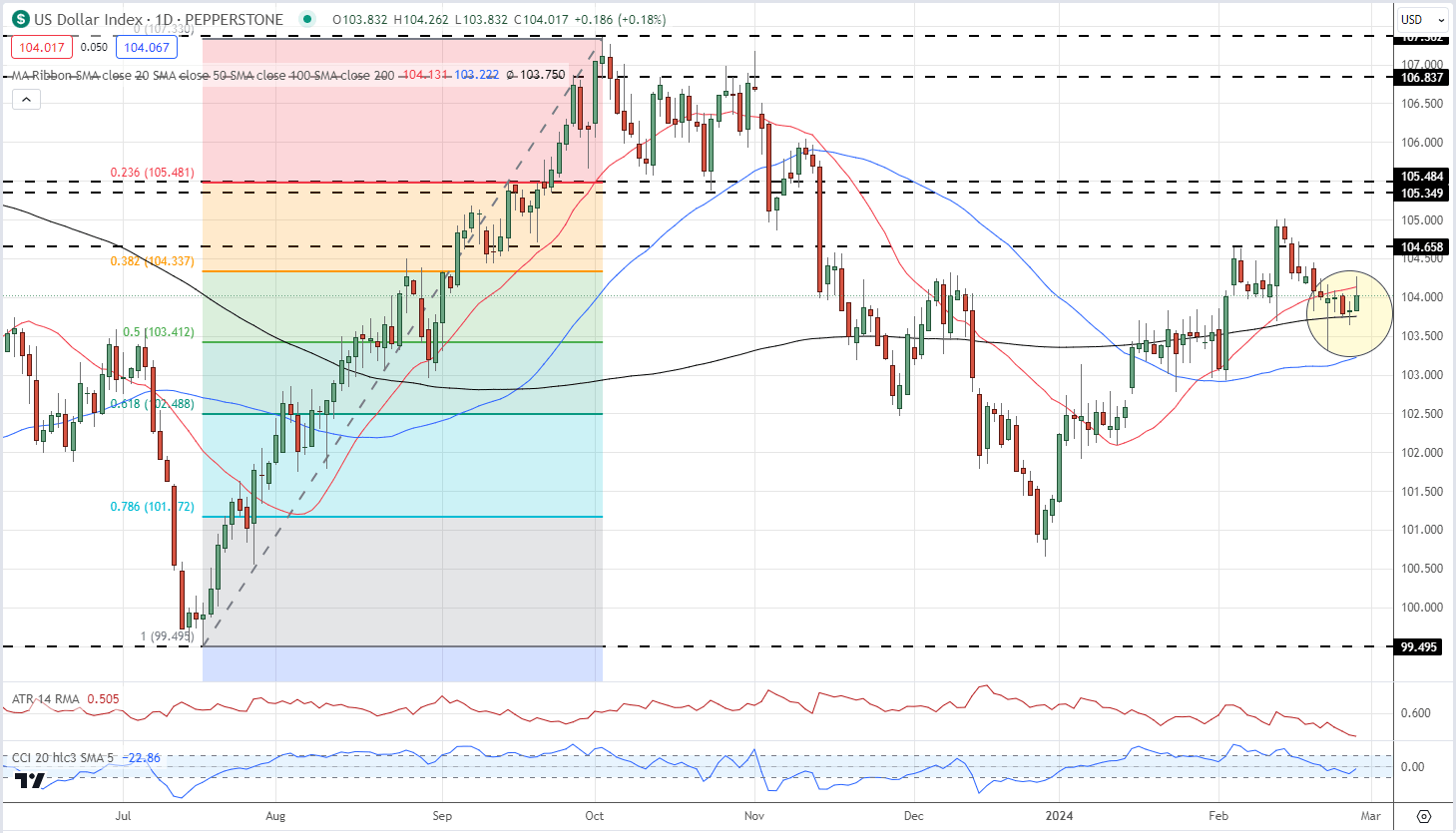

The US dollar slipped marginally lower after the release but the move was negligible. The greenback turned higher earlier in today’s session, helped in part by technical support from the 200-day simple moving average. Traders will now be looking forward to Thursday’s US PCE data, the Federal Reserve’s favoured inflation reading.

US Dollar Index Daily Chart

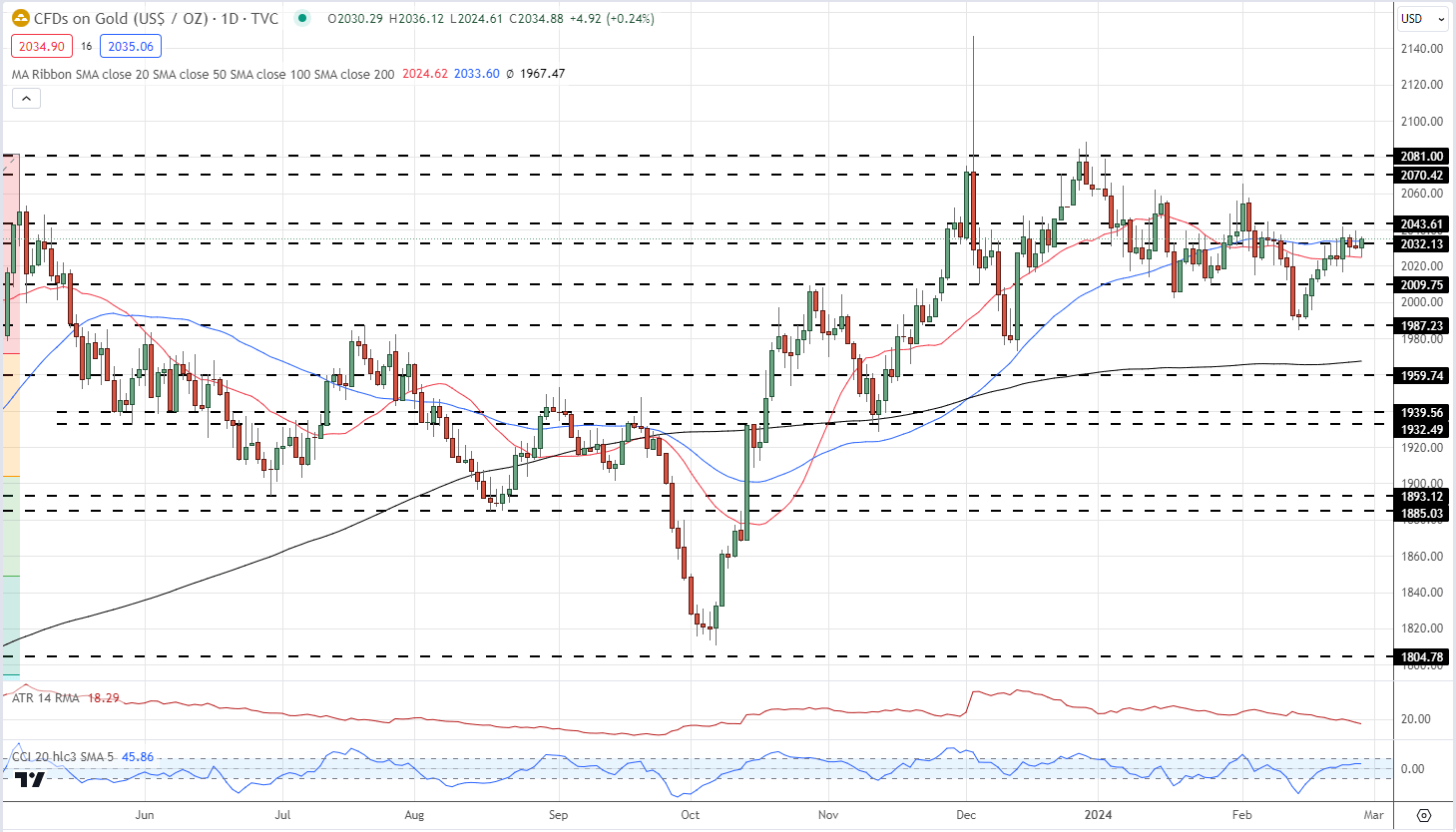

Gold turned slightly higher post-release but remains stuck in a narrow, short-term trading range. Resistance is seen at just under $2,044/oz. while support is seen at $2,025/oz. ahead of $2,010/oz.

Gold Price Daily Chart

Charts via TradingView

Retail trader data shows 62.45% of traders are net-long with the ratio of traders long to short at 1.66 to 1.The number of traders net-long is 8.38% higher than yesterday and 0.70% higher than last week, while the number of traders net-short is 10.27% lower than yesterday and 10.22% lower than last week.

See what this means for Gold

What is your view on the US Dollar and Gold – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.