Looking for the best trade ideas for Q4? Look no further and download your complimentary guide courtesy of the DailyFX team of Analysts and Strategists.

Tentative signs of stabilization in the Chinese economy, thanks to a spate of policy measures, coupled with oversold conditions, attractive valuations, and elevated pessimism suggest Hong Kong/China equities could be due for a rebound.

Recent China’s macro data have been less-worse than expected, as indicated by the Economic Surprise Index. The ESI is now close to neutral territory from near mid-2020 lows in July. Manufacturing activity appears to be stabilizing after NBS manufacturing PMI rose slightly last month.

Credit growth, industrial production, and retail sales came in better than expected in August, just as deflationary pressures are easing, raising the odds that growth may have troughed in Q3-2023, thanks to the momentum in support/stimulus measures. The finer details within the data sets also suggest bright spots could be emerging in the economy.

The pace of relief measures has gathered momentum in recent months, including cuts in key policy rates/lending rates, cuts in reserve requirement ratio, measures toward the property sector, and infrastructure spending. Early signs of a turnaround in macro data have motivated a few analysts to upgrade their economic growth forecasts for the current year. However, continued FX outflows and declining home prices suggest more fiscal and monetary measures could be needed to revive the property sector.

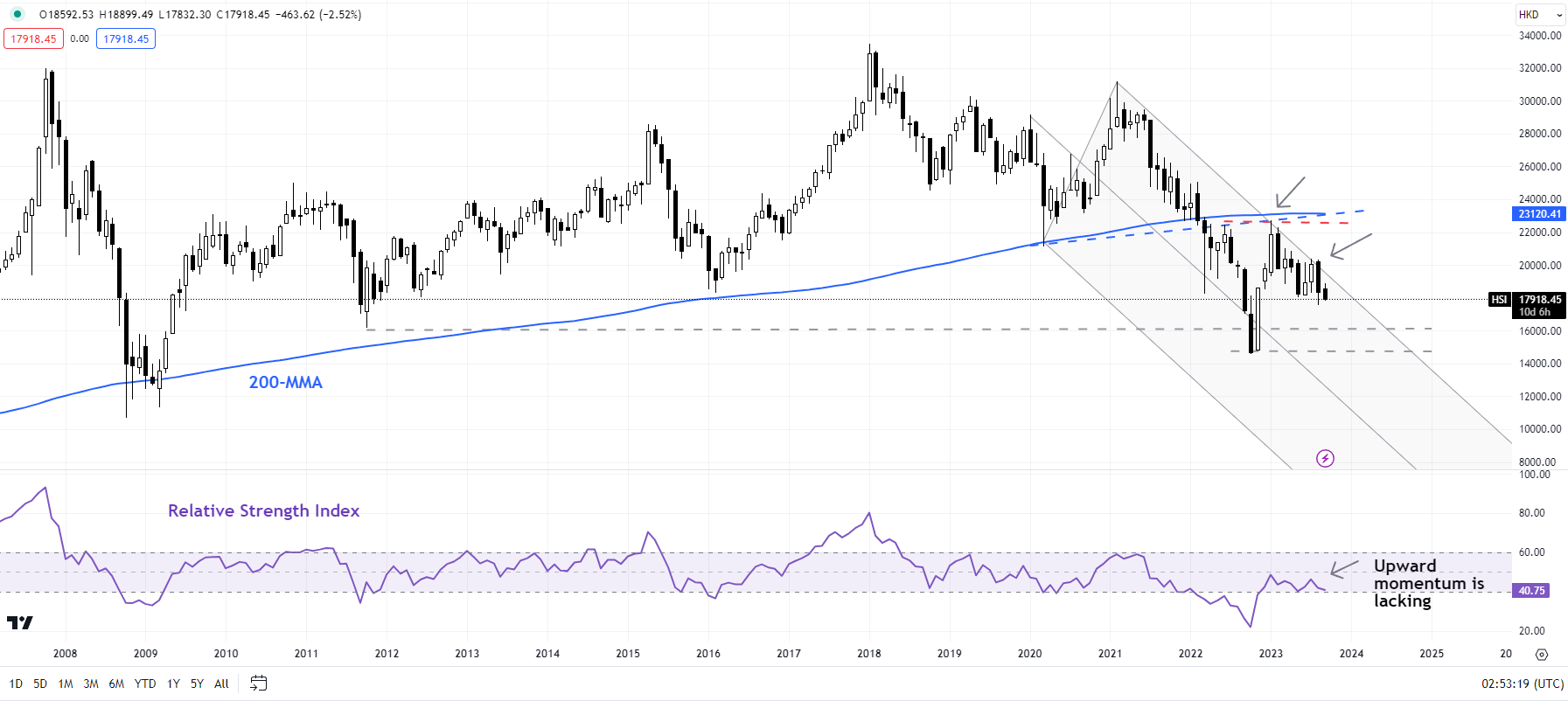

Hang Seng Index Monthly Chart

Chart Created Using TradingView

Meanwhile, the risk barometer on Hong Kong/China equities based on some market estimates is at elevated levels. Similar levels in the past have been associated with positive returns in equities over a multi-week period. However, timing the rebound can be tricky – indeed, there is no sign of a reversal of the downtrend on technical charts.

Looking at the big picture, on the monthly charts, the index has been nicely guided lower by a declining pitchfork channel since 2020. Despite the sharp rebound in Q1-2023, the 14-month Relative Strength Index failed to cross above the 50-mark, suggesting the early 2023 rebound was corrective.

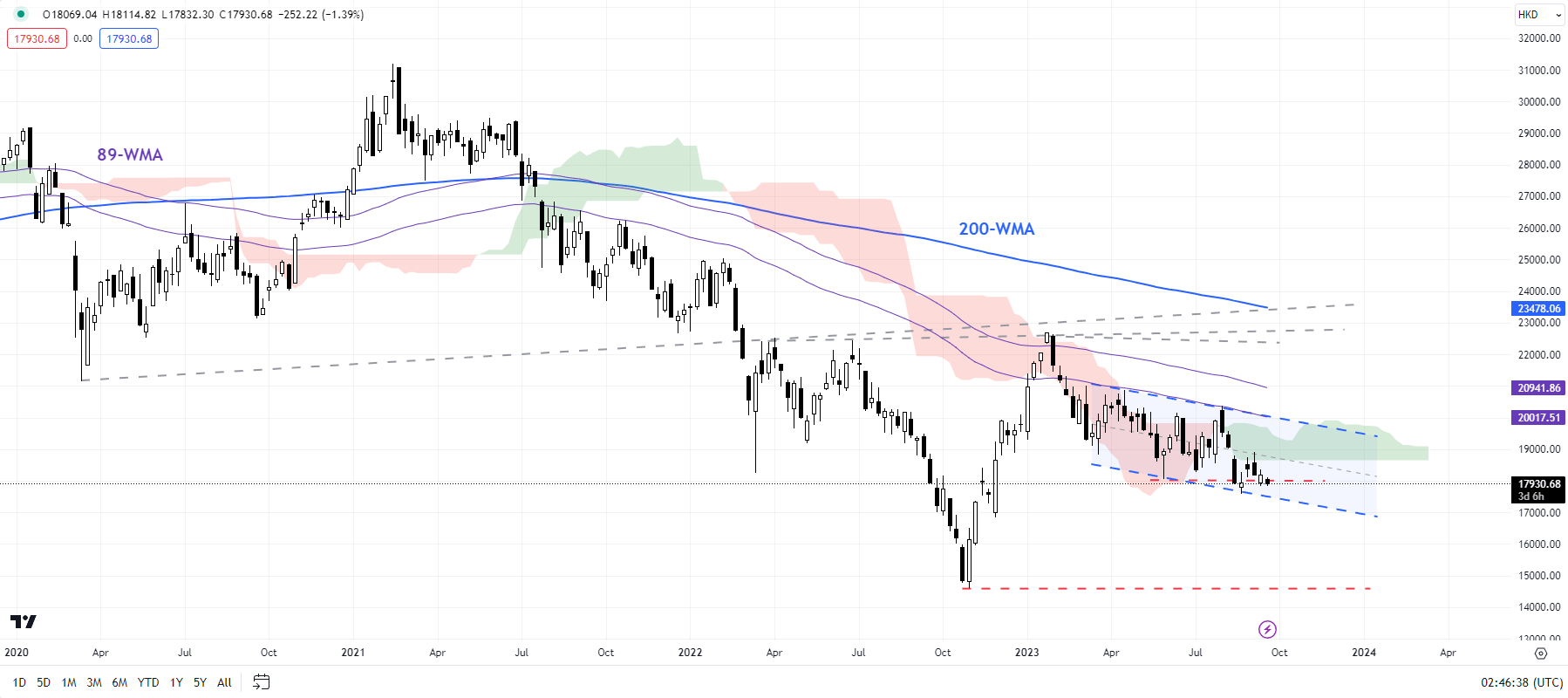

Hang Seng Index Weekly Chart

Chart Created Using TradingView

On the weekly charts, the index is at a crucial cushion area, including the May low of about 18000 and the lower edge of a declining channel since early 2023 (at about 17400). Below that, the next support is at the 2022 low of 14600. So far, the index has lacked any meaningful upward momentum. In this regard, the Hong Kong benchmark index would need to, at minimum, cross above the early-August high of 20300 for the immediate downside risks to fade. Until then, the balance of risks remains tilted toward the downside.

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.