Key Technical Levels for Major Indices

- Nikkei 225 stays side-lined

- Dow Jones Industrial Average rally runs out of steam

- Nasdaq 100 raly is slowing down

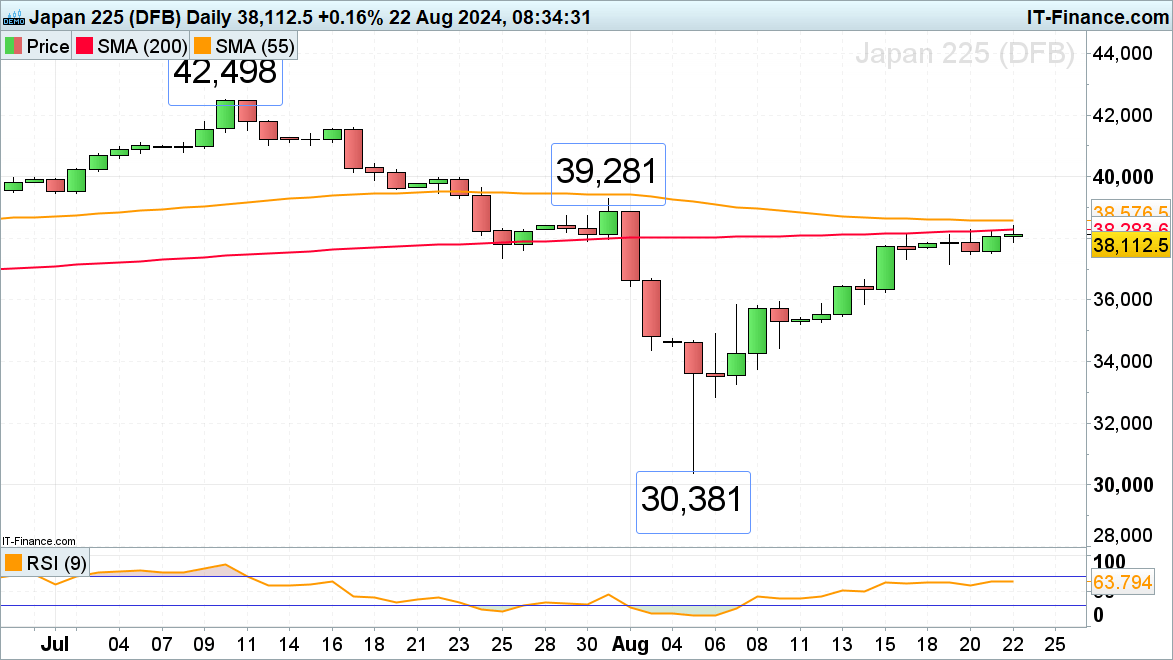

Nikkei 225 stays side-lined

The Nikkei 225 has been sideways trading around the 200-day simple moving average at 38,284 but below the 55-day SMA at 38,577 for the past week or so. Were the index to rise above both of the moving averages, the late July high at 39,281 would be next in line.

A slip through Monday’s 37,163 low would open the way for the 36,000 region to be revisited.

As long as Monday’s 37,163 low holds, the near-term bullish outlook remains intact.

Nikkei Daily Chart

Source: IG, ProRealTime, by Axel Rudolph

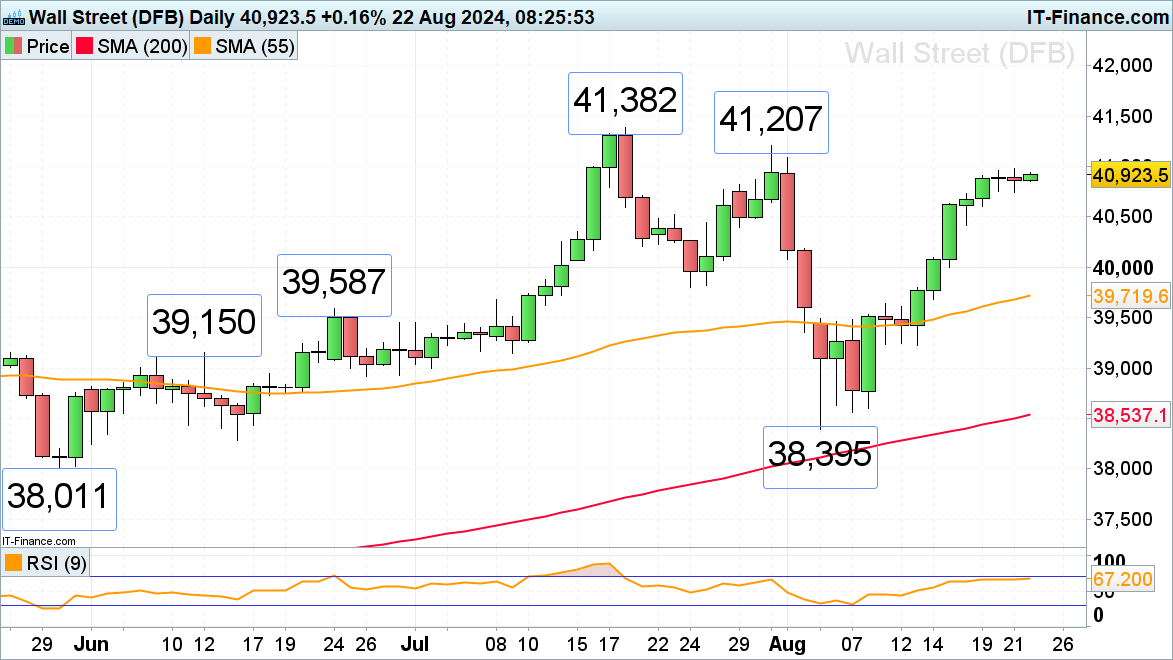

Dow Jones Industrial Average rally runs out of steam

The Dow Jones rally is running out of puff with low volatility and volume trading being prevalent as investors await Fed Chair Jerome Powell’s speech at the Jackson Hole symposium on Friday for more clues about the depth and speed of Fed rate cuts later this year.

Nonetheless the late July peak at 41,207 may still be reached. Just above it sits the all-time record high of 41,382. The uptrend should stay firm while 40,606, Monday’s low, contains downside.

Dow Jones Daily Chart

Source: IG, ProRealTime, by Axel Rudolph

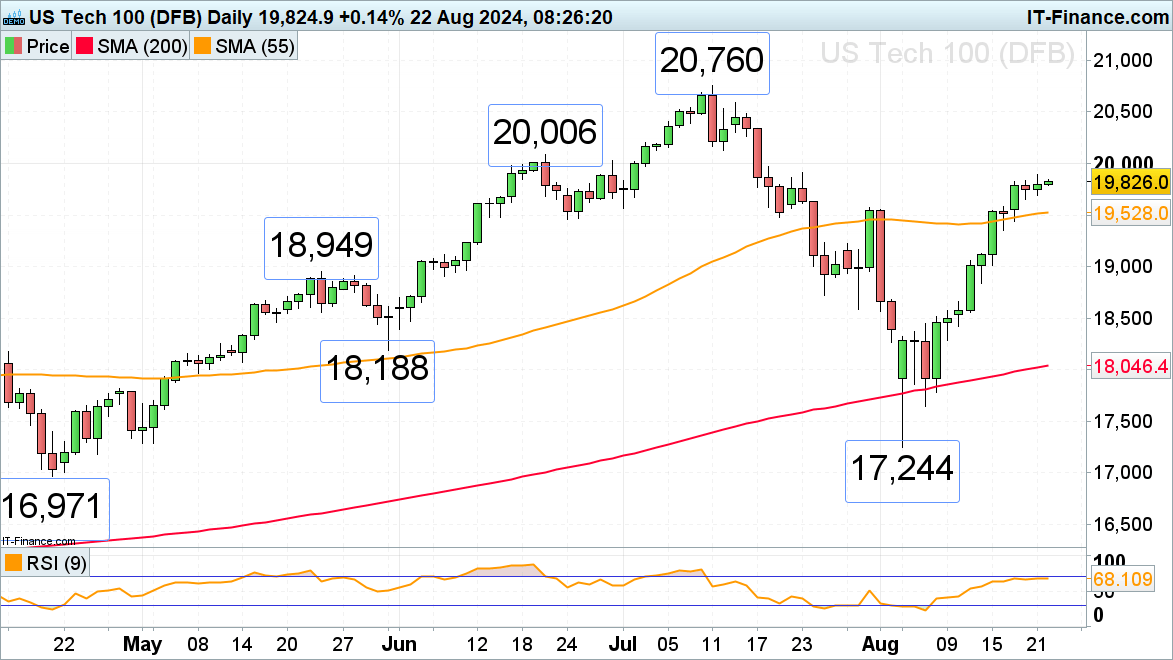

Nasdaq 100 rally is slowing down

The Nasdaq 100’s rise above the 55-day moving average at 19,528 and the 19,577 late July high has put the 20,006 June high in its path.

Previous resistance around 19,577-to-19,501 should now flip to support as per the inverse polarity principle where previous resistance tends to act as support and vice versa.

Nasdaq 100 Daily Chart

Source: IG, ProRealTime, by Axel Rudolph

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.