Most Read: Gold Price Trade Setup – Bearish Scenario Contingent on Support Breakdown

In trading, the temptation to follow prevailing trends is strong—buying during bullish phases and selling in bearish ones. However, seasoned traders often discover that the best opportunities arise from unconventional strategies. One such method is contrarian trading, which involves going against the dominant market sentiment to capitalize on potential shifts.

Contrarian strategies are not designed to challenge the majority viewpoint arbitrarily. Instead, they focus on identifying moments when the consensus may be incorrect and seizing those opportunities. Tools like IG client sentiment provide valuable insights into crowd psychology, highlighting periods of extreme optimism or pessimism that may signal an impending change.

However, contrarian signals alone do not guarantee success. Their true value emerges when they are integrated into a comprehensive strategy that combines both technical and fundamental analysis. This holistic approach enables traders to uncover deeper market dynamics that are often missed by those who follow prevailing trends.

To illustrate this concept, let’s examine how IG’s client sentiment data and current retail investor positioning can guide trading decisions for three popular assets: EUR/USD, USD/CAD, and the Dow Jones 30. By analyzing these cases, we will demonstrate how contrarian thinking can offer insights into near-term market direction.

For a complete overview of the EUR/USD’s technical and fundamental outlook for the coming months, make sure to download our complimentary Q2 forecast!

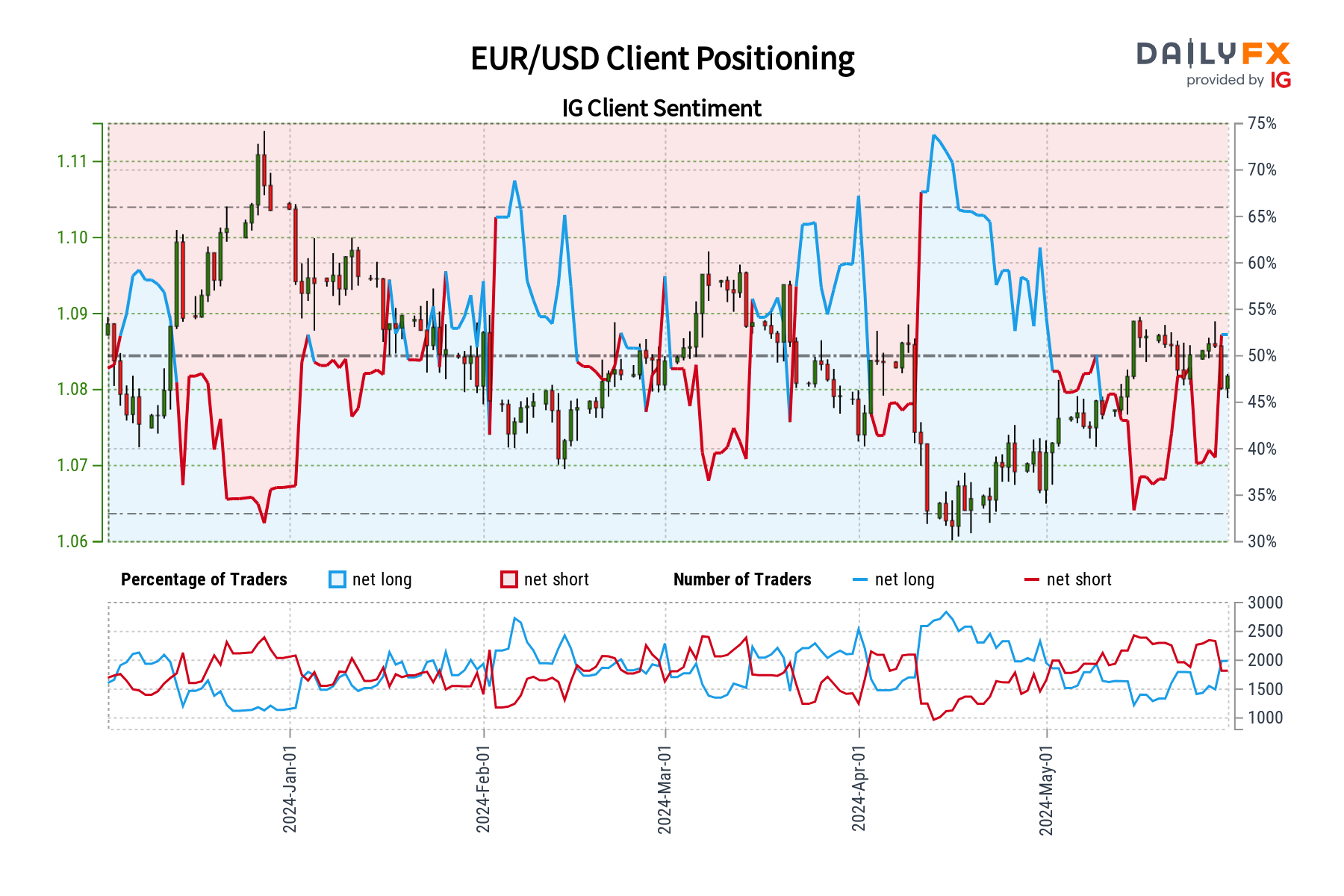

EUR/USD FORECAST – MARKET SENTIMENT

According to IG data, 50.87% of clients betting on EUR/USD’s direction are bullish, with the ratio of traders long to short at 1.04 to 1. The number of buyers has surged by 23.99% since yesterday and is 13.24% higher than prevailing levels seven days ago. Meanwhile, short positions have fallen by 15.17% and 10.11%, respectively, in those periods.

Our strategy often involves taking a contrarian stance to crowd mentality. That said, the fact that the retail segment is net-long EUR/USD indicates potential for the pair to decline further in the near term. With traders more bullish than they were both yesterday and a week ago, the existing sentiment and the recent shifts in positioning heighten our bearish contrarian bias on EUR/USD.

Interested in learning how retail positioning can shape the short-term trajectory of USD/CAD? Our sentiment guide has all the answers. Download your free guide now!

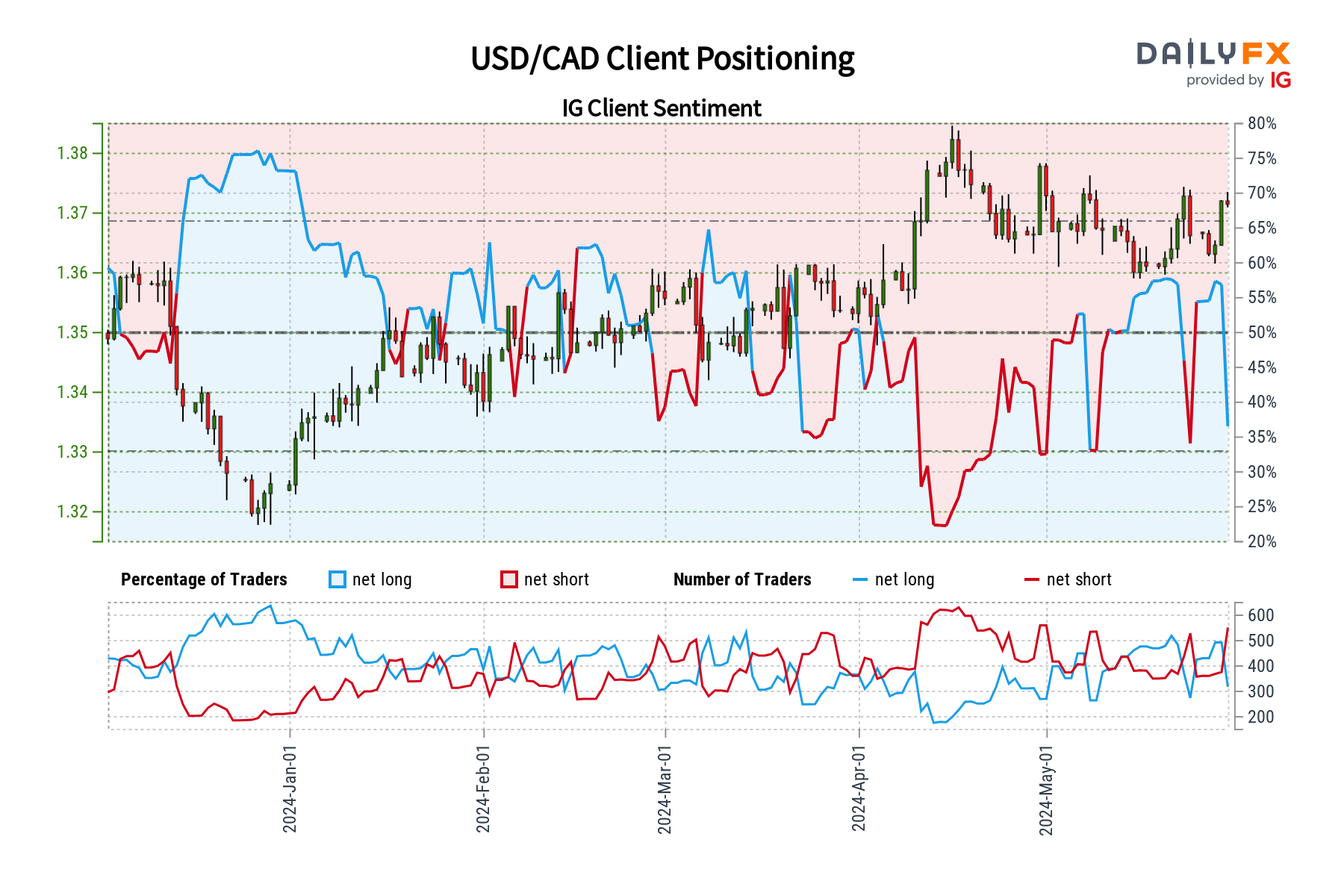

USD/CAD FORECAST – MARKET SENTIMENT

IG data reveals that 66% of the retail crowd trading USD/CAD is positioned for weakness, with the ratio of short-to-long sitting at 2.27 to 1. The number of sellers has risen by 47.98% compared to the last session and by 44.21% over the week. At the same time, net long wagers are down 43.62% from yesterday and 29.56% versus seven days ago.

We typically hold a contrarian perspective on market sentiment, and traders being net-short on USD/CAD signals potential upward movement for the pair. The rise in selling interest over important timeframes for our analysis, paired with current mood and shifts in market positioning, bolsters our bullish contrarian trading bias for USD/CAD.

Elevate your trading prowess with a comprehensive analysis of equity market indices, encompassing both long-term fundamentals and technical insights. Get the quarterly forecast now!

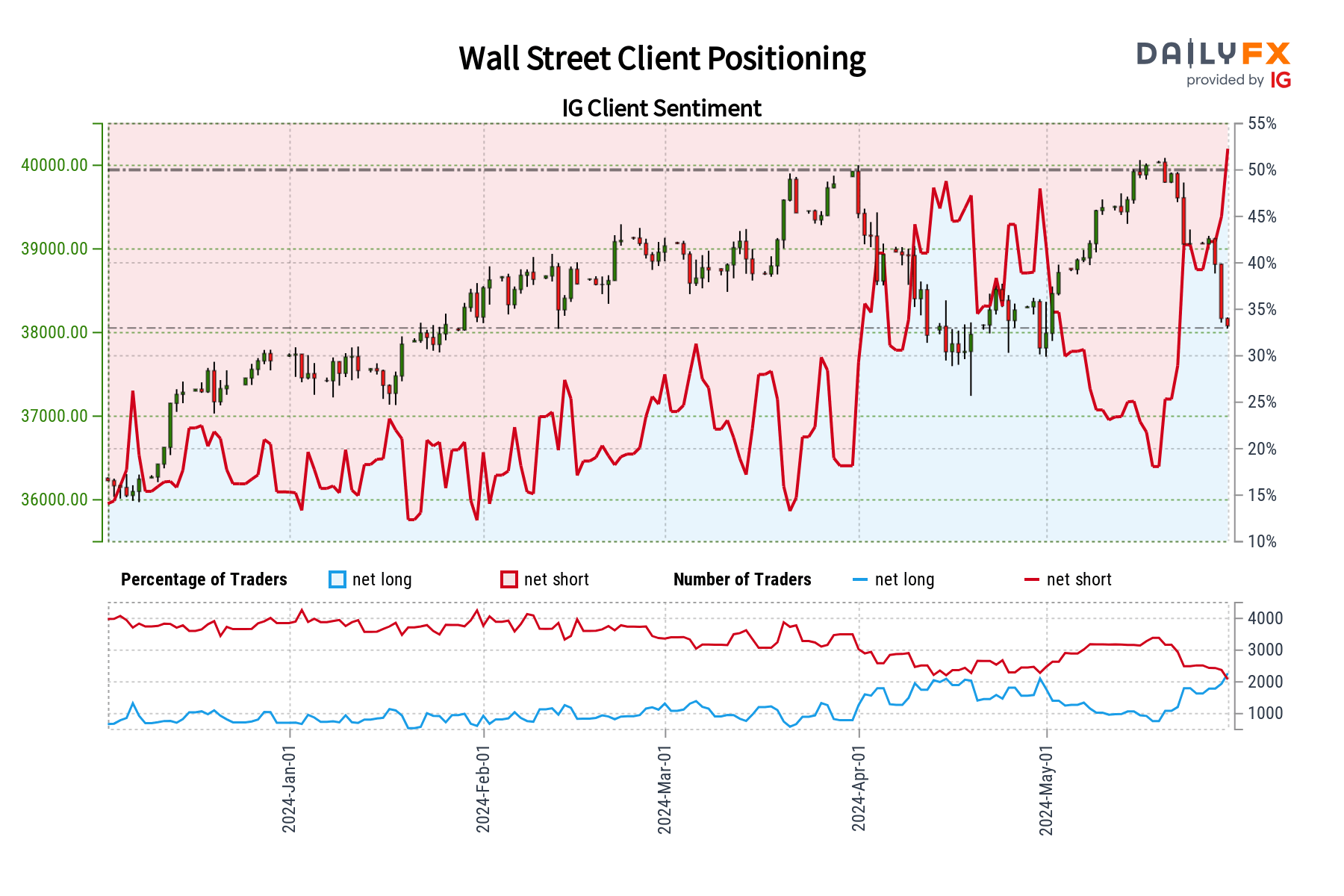

DOW JONES 30 FORECAST – MARKET SENTIMENT

IG proprietary data shows that 54.25% of traders speculating on the Dow Jones 30’s path is positioned for strength, resulting in a long-to-short ratio of 1.19 to 1. Notably, the number of clients net long has risen by 24.50% compared to yesterday and a striking 107.54% since last week. Conversely, bearish positions have decreased by 12.87% and 29.52% across the respective timeframes.

Our strategy diverges from mainstream thinking, and the current situation, where traders are bullish on the Dow Jones’s outlook, implies a potential for equity market weakness in the short term. The uptick in clients’ net-long positions compared to both yesterday and last week reinforces our bearish contrarian bias on the blue-chip index.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.