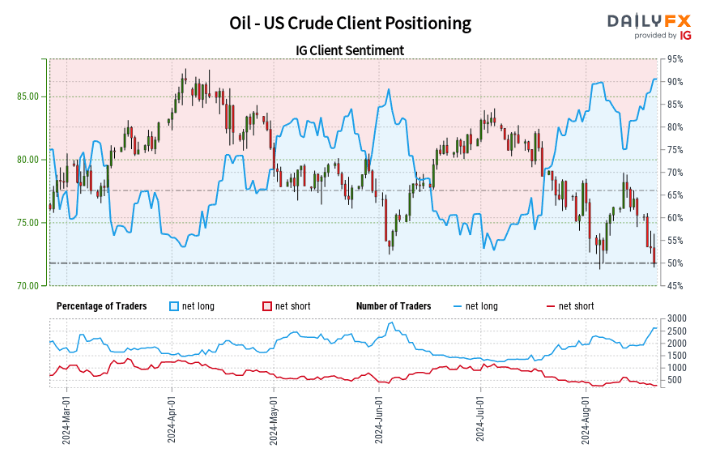

Oil – US Crude:

The oil market has continued to trade lower as the outlook for global oil demand growth comes under pressure. The Fed is expected to cut interest rates next month after a deterioration in the labour market saw the unemployment rate rise unexpectedly to 4.3% in July. Yesterday, minutes of the July Fed meeting teed up September for a 25 basis point (bps) cut but markets still price in a 30% chance of a 50 bps cut first up. While, risk assets like the S&P 500 and the Australian dollar have fully recovered from the early August panic and even built on those gains, oil continues to trade lower.

Retail trading figures show an overwhelming 90.50% of traders in long positions, with a long-to-short ratio of 9.53 to 1. Long positions have grown by 10.62% since yesterday and 37.49% from last week. Short positions have declined by 14.59% since yesterday and 38.38% from last week. Adopting a contrarian stance on market sentiment combined with the heavy bias towards long positions, Oil – US Crude prices may decline further.

The increase in long positions and decrease in short positions over both daily and weekly periods adds to the bearish contrarian outlook on Oil – US Crude.

US Crude Daily Chart with IG Client Sentiment Overlay

Source: IG, DailyFX, prepared by Richard Snow

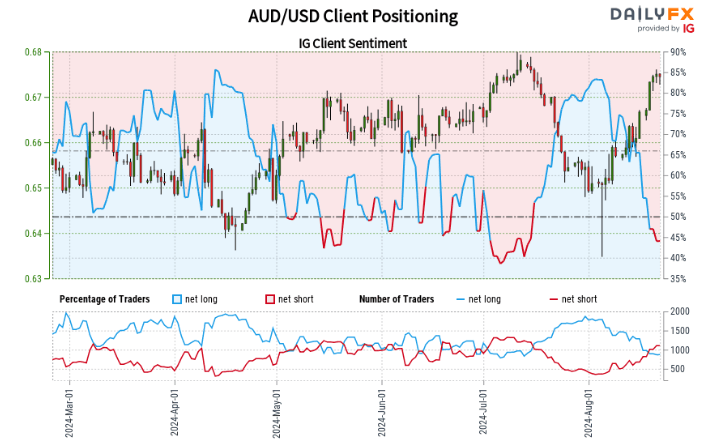

AUD/USD:

Retail trading statistics indicate that 43.19% of traders hold long positions, with a short-to-long ratio of 1.32 to 1. Compared to yesterday, there’s a slight 0.57% increase in long positions, but a significant 31.47% decrease from last week. Short positions have risen by 5.45% since yesterday and jumped 73.65% from last week. A contrarian approach typically counters popular sentiment, so the predominance of short positions suggests AUD/USD may trend upward.

The intensification of short positions both daily and weekly reinforces a bullish outlook on AUD/USD based on contrarian analysis.

AUD/USD Daily Chart with IG Client Sentiment Overlay

Source: IG, DailyFX, prepared by Richard Snow

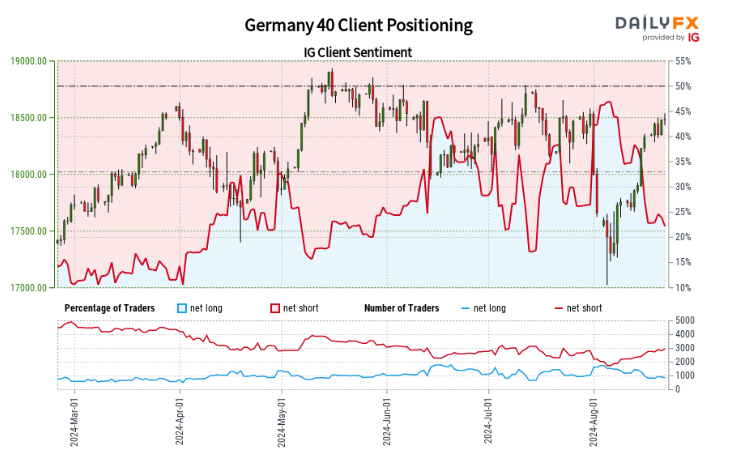

Germany 40 (DAX):

Trading data reveals 22.06% of retail traders are in long positions, with shorts outnumbering longs by 3.53 to 1. Long positions have decreased by 10.89% since yesterday and 33.98% from last week. Short positions have increased by 4.67% since yesterday and 23.61% from last week. When adopting a contrarian approach to market sentiment, combined with the prevalence of short positions, Germany 40 prices may rise further.

The growing short interest over both daily and weekly timeframes strengthens a bullish contrarian perspective on Germany 40.

DAX Daily Chart with IG Client Sentiment Overlay

Source: IG, DailyFX, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.