Gold (XAU/USD) Analysis

- After a hot growth print for Q3, gold appears more subdued but PCE may reignite the bull run

- Gold threatens to test all-time-high of $2081 should $2050 hold this week

- US exceptionalism at risk as economic fortunes sour in the US (sentiment and hard data)

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Gold Takes a Breather Ahead of US PCE Data

Markets continue to react to incoming data and are expected to be sensitive to further growth and inflation indicators as the expectation for interest rate cuts filters across markets. Yesterday, the second revision to US GDP for the third quarter surpassed the prior reading as well as consensus estimates – helping provide support for the US dollar.

Better than expected growth data for Q3 contrasts what we are seeing unfolding in Q4. Activity, sentiment and growth data have all revealed a tendency to underwhelm, leading markets to price in accommodative interest rate cuts sooner than the Fed has indicated and at twice the magnitude too. Expectations of a lower Fed funds rate, releases steam from the elevated US dollar – presenting a discount for foreign buyers of the metal as gold is priced in US dollars.

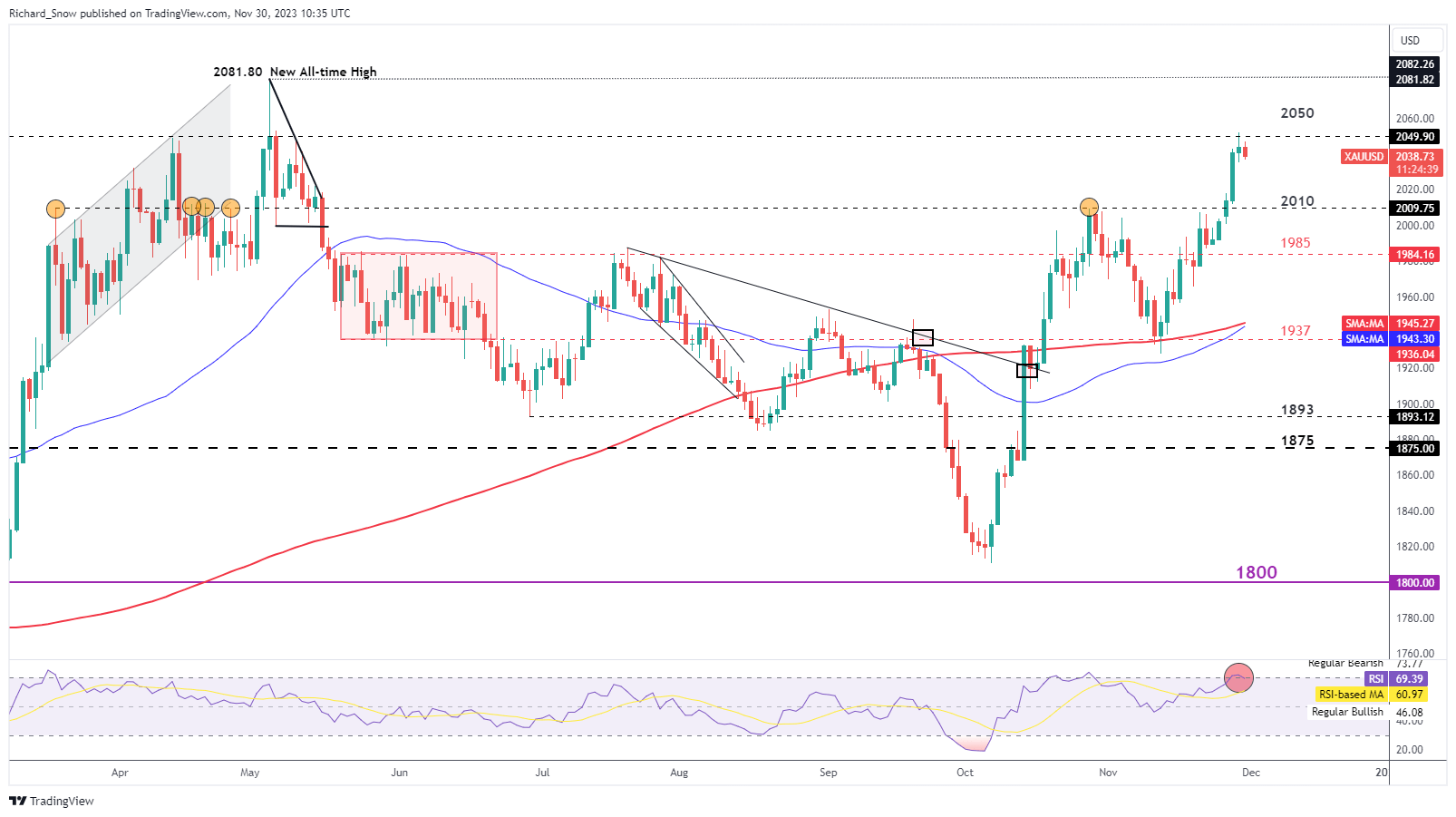

Gold Threatens to Test All-Time-High Should $2050 Hold This Week

After Fed Governor Christopher Waller suggested rate cuts could emerge within the next 3-5 months the dollar selloff gained momentum, elevating gold. The resurgent move appears to have found immediate resistance at $2050 where prices have edged lower after US Q3 GDP appears to have outperformed the already impressive initial estimate of 4.9% growth (annualized).

Support appears at $2010 but pullbacks have been shallow recently and a lower then anticipated PCE print could quickly send gold prices higher once again. Those eying up a potential bullish continuation would want to see the gold price hold above $2050 into the weekend. The RSI has entered and is appearing to recover from oversold territory – a potential headwind for an immediate bullish continuation.

Gold Daily Chart

Source: TradingView, prepared by Richard Snow

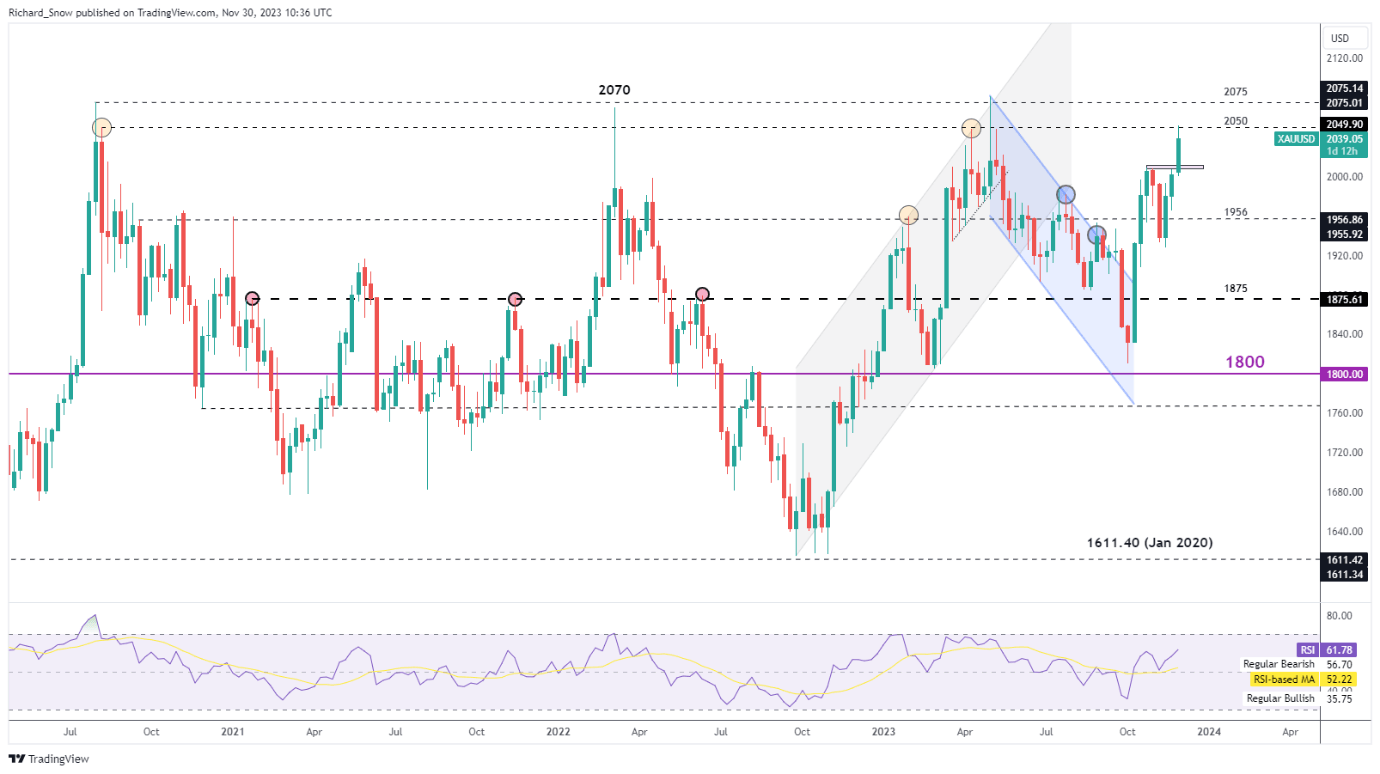

The weekly chart helps to frame the recent rise and highlights the importance of the $2050 level.

Gold Weekly Chart

Source: TradingView, prepared by Richard Snow

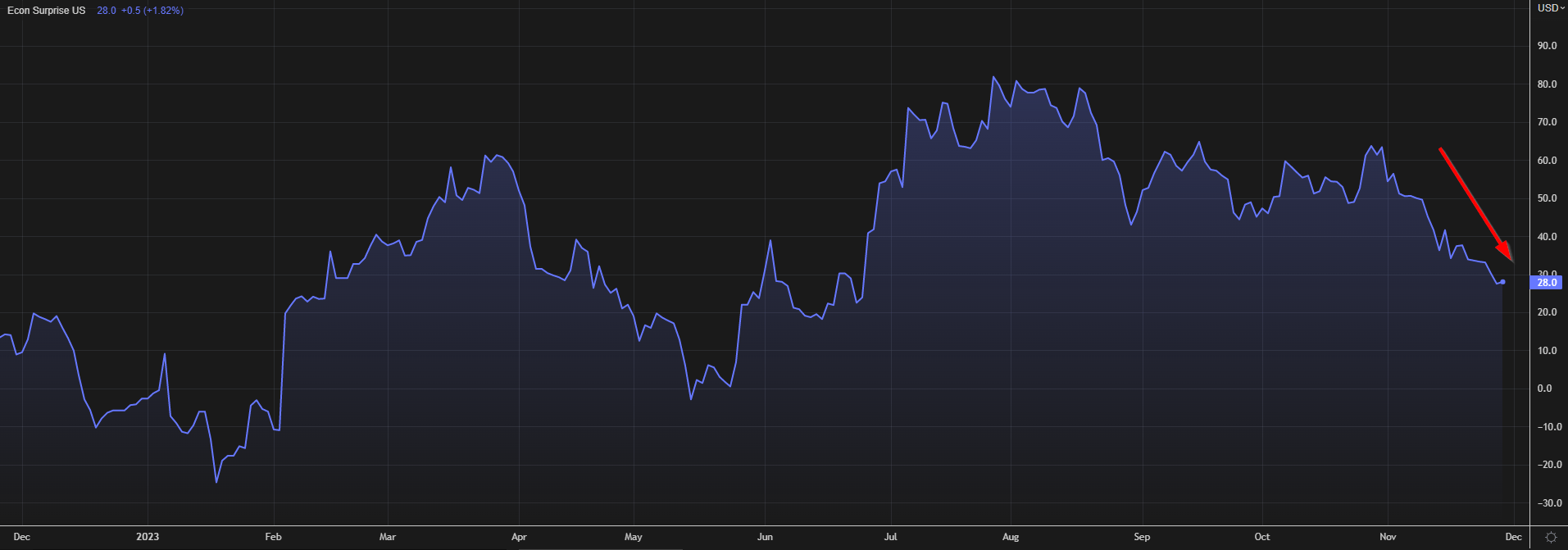

A number of drivers behind the gold price appear to be pulling in the same direction. Interest rate expectations see rate cuts ramping up into 2024, US yields and the dollar have both moved away from their relative peaks while gold maintains its safe haven appeal amidst the ongoing geopolitical conflict. Softer economic data has been observed across the US, from sentiment data to hard data like NFP, retail sales and GDP growth to name a few. The chart below shows the drop-off in general US data revealed by the Citi economic surprise index:

Citi Economic Surprise Index

Source: Refinitiv, prepared by Richard Snow

If you’re puzzled by trading losses, why not take a step in the right direction? Download our guide, “Traits of Successful Traders,” and gain valuable insights to steer clear of common pitfalls that can lead to costly errors.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.