FTSE 100, DAX 40, S&P 500 Analysis and Charts

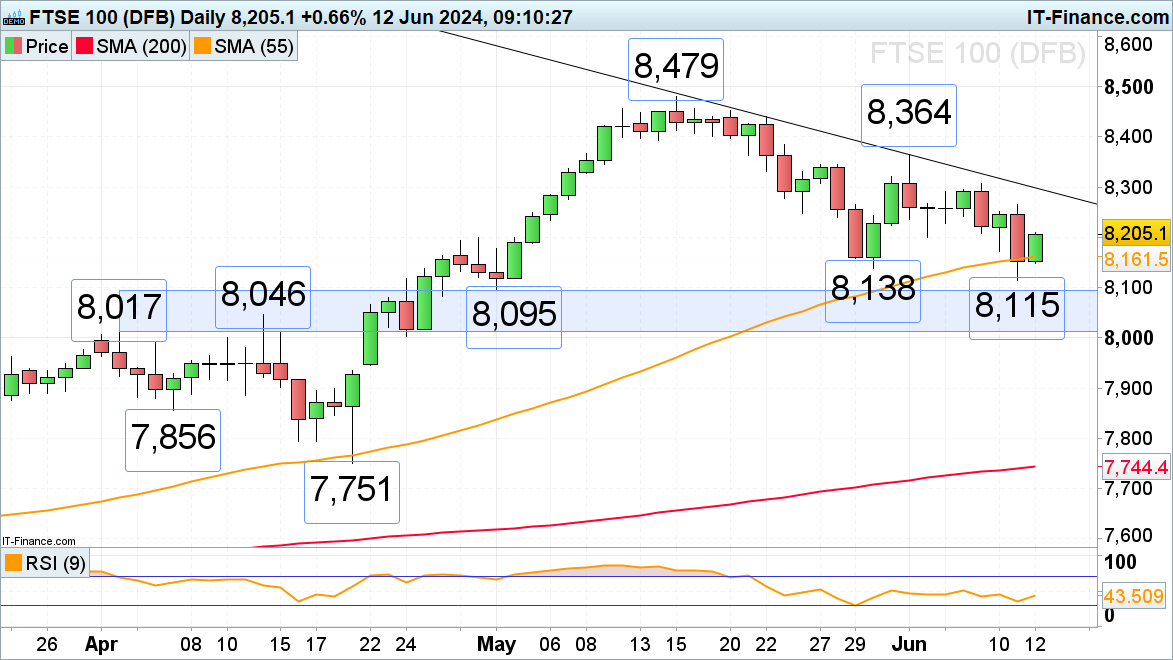

FTSE 100 in recovery mode despite flat month-on-month GDP growth

The FTSE 100 recovered from Tuesday’s 8,115 low despite UK GDP seeing its weakest performance in four months, as a drop in industrial output and construction offset a rise in services. A further rise will likely depend on US CPI data and the outcome of today’s FOMC meeting. For the bulls to be back in control, a rise above Tuesday’s high at 8,266 would need to occur.

Potential slips may find support along the 55-day simple moving average (SMA) at 8,162, ahead of the 8,138 to 8,115 late May and current June lows.

FTSE 100 Daily Chart

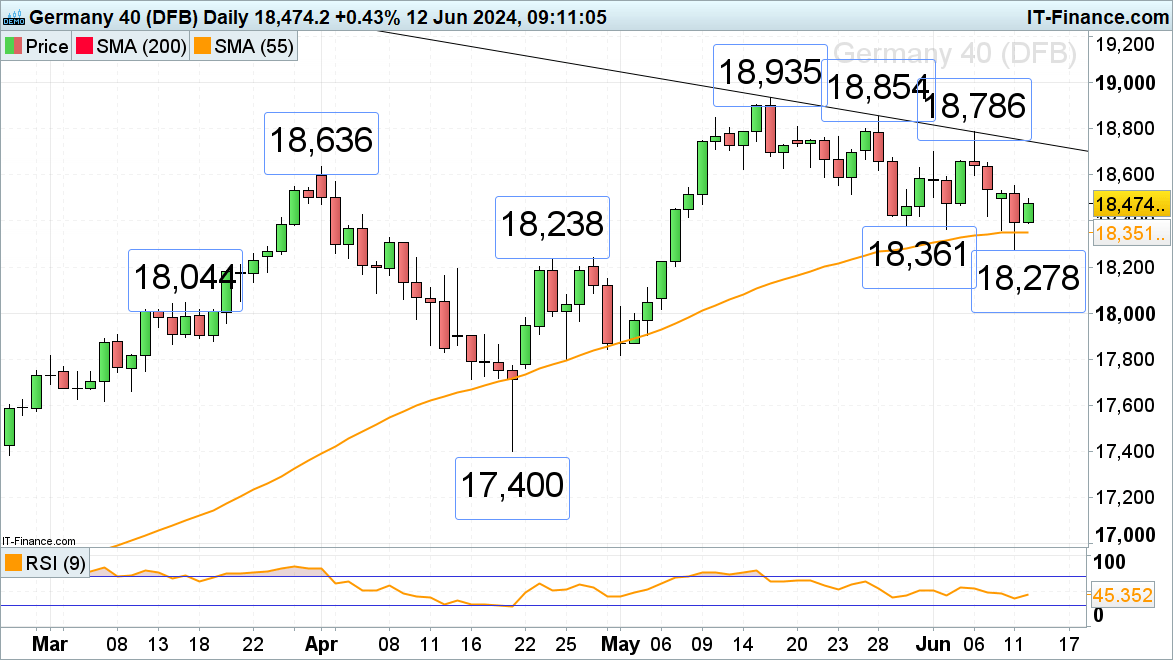

DAX 40 bounces off a one-month low

The DAX 40 is seen recovering from Tuesday’s 18,278 one-month low ahead of US inflation data and today’s Fed meeting. A rise above Tuesday’s high at 18,552 is needed, for a bullish reversal to gain traction.

Minor support is seen between the late May and early June lows at 18,379 to 18,361, ahead of the 55-day simple moving average (SMA) at 18,352. Provided that this week’s low at 18,278 underpins, a rise back towards the 18,700 region may ensue. Failure at 18,278 would put the 18,238 late April high on the cards, though.

DAX 40 Daily Chart

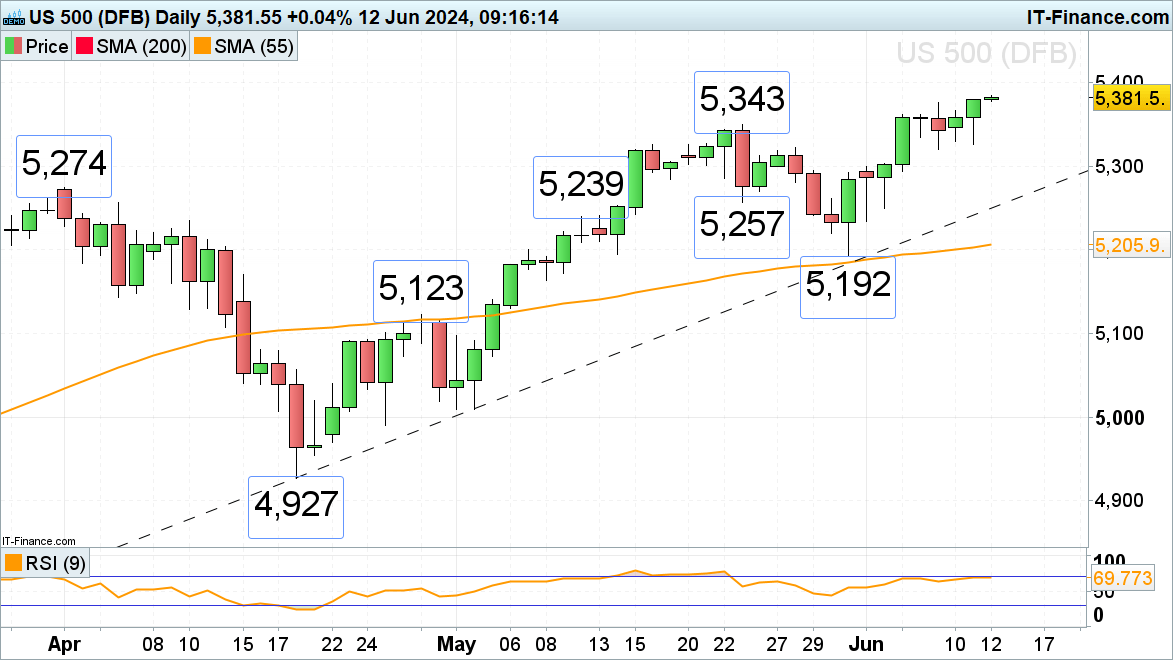

S&P 500 trades in record highs ahead of US CPI and FOMC

The S&P 500 trades in all-time highs around the 5,380 mark ahead of today’s US inflation print and the culmination of the FOMC meeting. While Tuesday’s low at 5,327 underpins, the 5,400 mark remains in sight.

Potential slips may find support around last week’s 5,376 high, ahead of Friday’s and Tuesday’s 5,327 to 5,320 lows. While these hold, the short-term uptrend stays intact.

S&P 500 Daily Chart

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.