Euro, EUR/USD, US Dollar, EUR/JPY, Trend Breakout, Candlestick, Bollinger Bands – Talking Points

- Euro bulls were rewarded earlier last week before a pullback surfaced

- The technical set-up from the recent rally might see Euro bears re-enter the fray

- The squeeze higher appears to have been rejected for now. Will EUR/USD go lower?

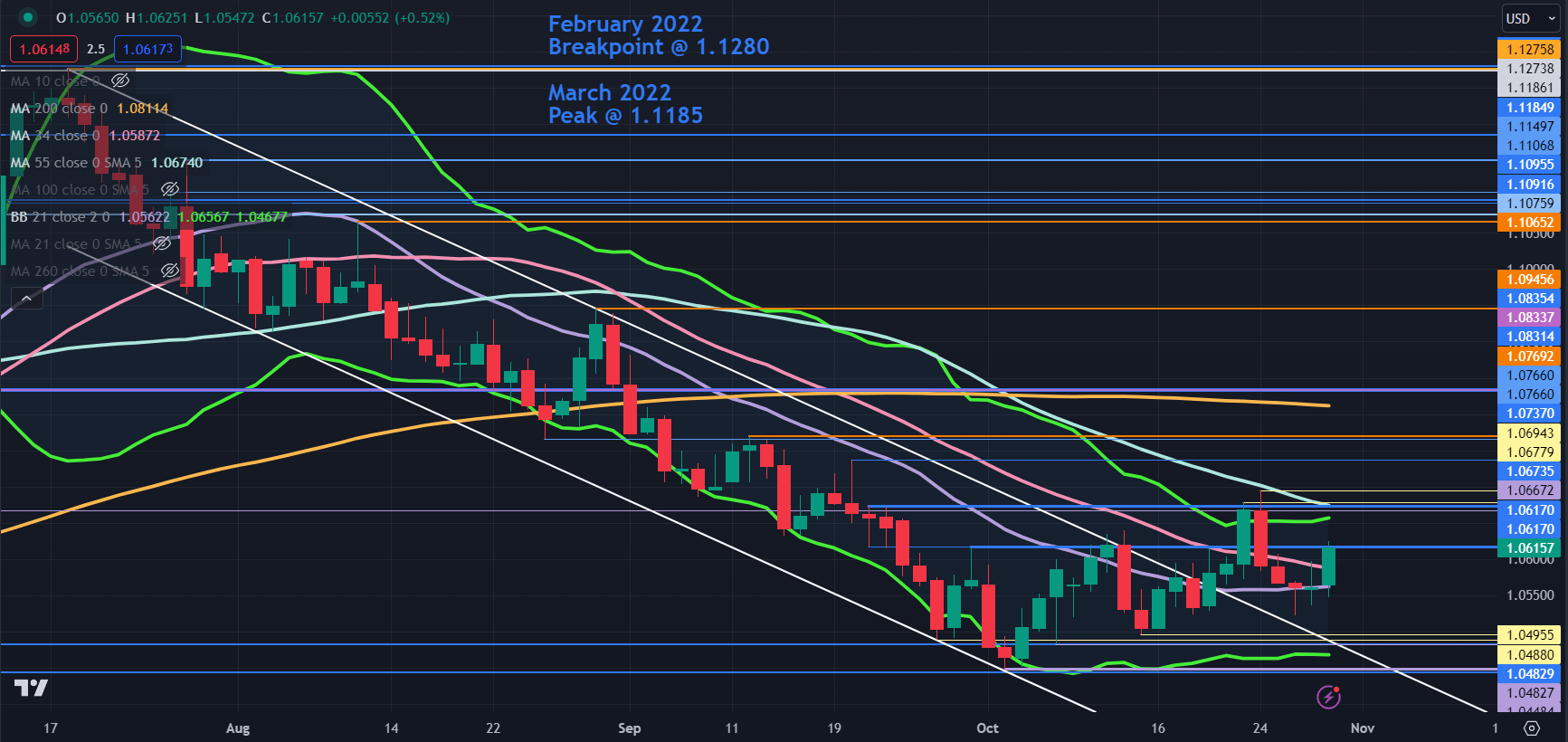

EUR/USD TECHNICAL ANALYSIS

EUR/USD cleanly broke through the topside of a descending trend channel to start last week, briefly pierce minor resistance levels near 1.0680 to make a high at 1.0695.

The price action on the day that the price made that high saw a Bearish Engulfing Candlestick

formation emerged and it has gone lower in the proceeding days.

A Bearish Engulfing Candlestick opens at, or above the previous candle’s close. The length of the bearish candle ‘engulfs’ the previous green candle and it then closes below the prior candle’s open.

This reversal might signal that the descending trend may re-emerge.

The recent rally broke above the upper band of the 21-day simple moving average (SMA) based Bollinger Band. On the same day that Engulfing Candlestick materialised, the price closed back inside the band.

This potentially adds weight to the perspective that a reversal could be in play.

A bearish triple moving average (TMA) formation requires the price to be below the short-term SMA, the latter to be below the medium-term SMA and the medium-term SMA to be below the long-term SMA. All SMAs also need to have a negative gradient.

When looking at any combination of the 21-, 34-, 55- and 100-day SMAs, the criteria for a TMA have been met and might suggest that bearish momentum is evolving.

On the downside, nearby support might lie near the previous lows and breakpoints in the 1.0480 – 1.0495 area ahead of the lows seen in December 2022 and October 2023 near 1.0445.

On the topside, the 55-day SMA is currently near the recent peak and there might be a resistance zone ahead of 1.0700.

The next resistance levels could be at the breakpoints and previous highs near 1.0740, 1.0770, 1.0835 and 1.0945 ahead of a cluster zone of potential resistance in the 1.1075 – 1.1100 area.

EUR/USD DAILY CHART

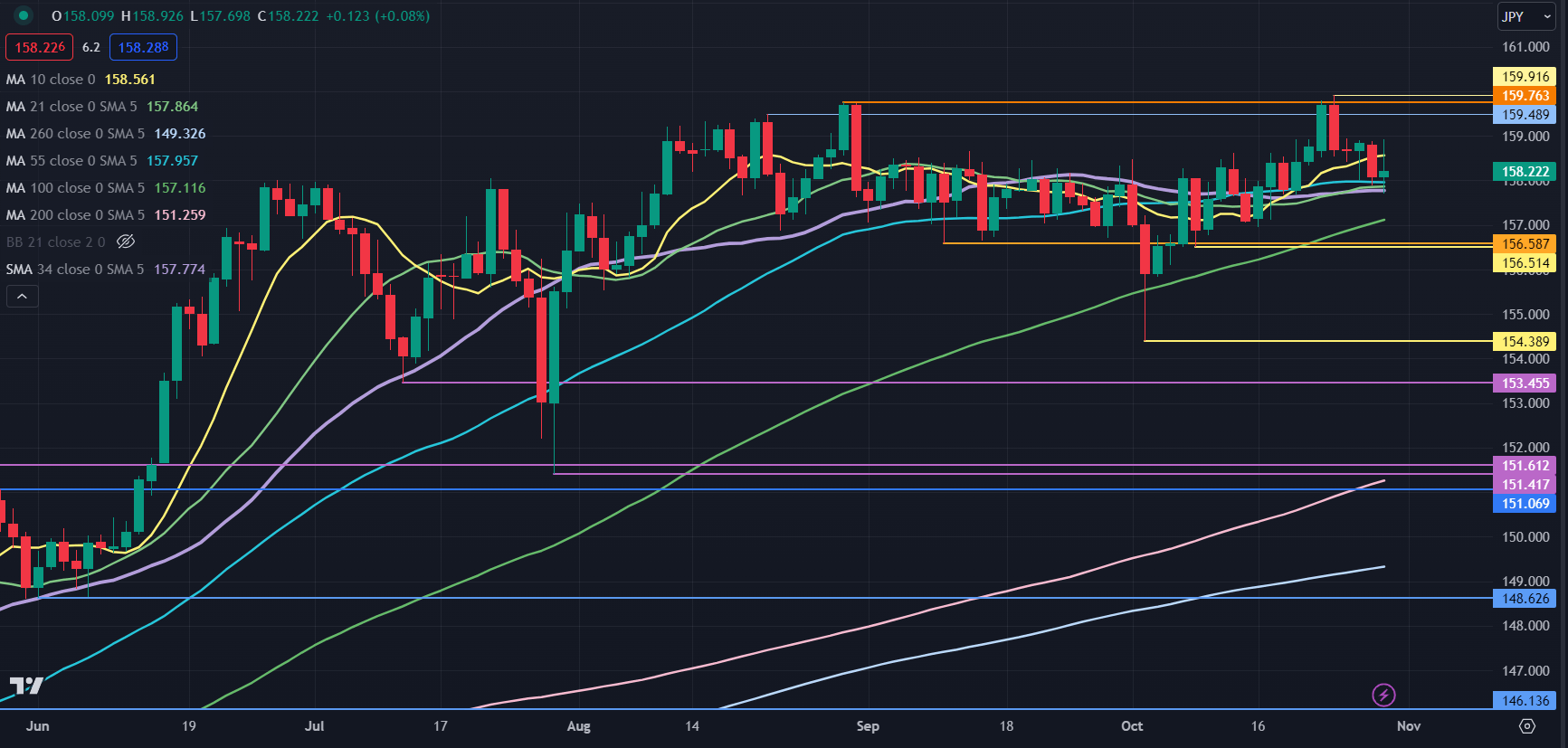

EUR/JPY TECHNICAL ANALYSIS

EUR/JPY appears to have settled back into its recent range after rejecting the move higher last week when it popped above the August to peak to trade at its highest level since 2008.

In the discussion above, EUR/USD seems to have a bearish TMA formation, but looking at the Simple Moving Averages (SMA) on EUR/JPY, a bullish TMA might emerge if the price edges higher.

The hindering factor is the clustering of the 21, 34- and 55-day SMAs. If the price stays above those SMAs, then it is likely that the conditions for a bullish TMA pattern will be triggered.

On the downside, support could be at the breakpoint and a recent low toward 156.50. On a sustained move lower, the levels to watch might be at the previous lows and breakpoints of 154.39, 153.45, 151.60, 151.40 and 151.07.

On the top side, the recent highs and breakpoint near 159.50, 159.75 and 159.90 may offer resistance.

EUR/JPY DAILY CHART

— Written by Daniel McCarthy, Strategist for DailyFX.com

To contact Daniel, use the comments section below or @DanMcCathyFX on Twitter

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.