EUR/USD ANALYSIS

- Focus on China, Israel-Palestine and economic data.

- EUR/USD could re-test yearly lows at 1.0445.

Elevate your trading skills and gain a competitive edge. Get your hands on the Euro Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

EURO FUNDAMENTAL BACKDROP

The euro ended the weak lower after the US dollar received support from escalating geopolitical tensions in the Middle East via its safe haven appeal. Should this trend continue, the proc-cyclical EUR/USD will likely extend its downside.

US CPI and the Michigan consumer sentiment report both showed signs of sticky inflationary pressures to come that has supplemented the USD. Although there is little chance of an interest rate hike for the November meeting, there may be some knock-on effect down the line, particularly if crude oil prices continue to rise.

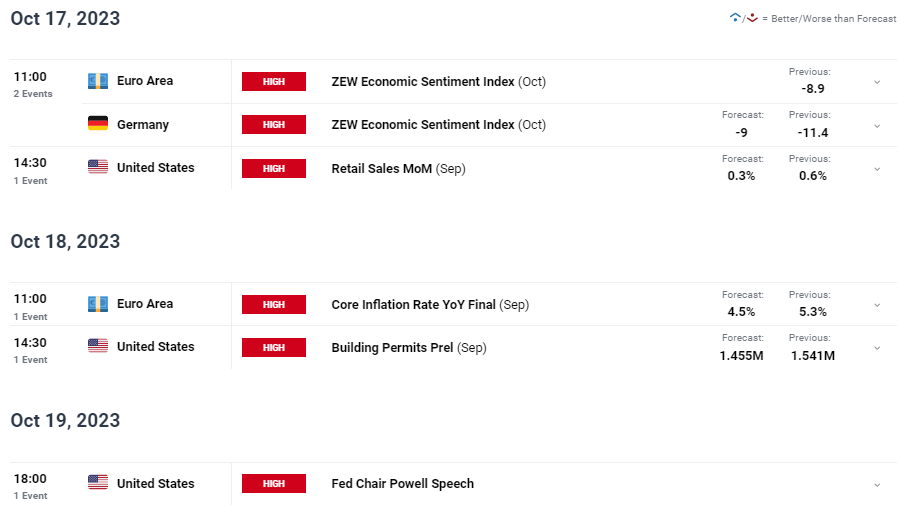

The week ahead is relatively quiet but will contain a few key sets of data including the US retail sales report and euro area core inflation. Retail sales is expected to come in lower which could see some dovish re-pricing of the Fed’s rate forecasts. Euro core inflation is also anticipated lower and with European Central Bank’s (ECB) officials remaining pensive around turning too accommodative too soon, this may change and weigh negatively on the EUR. To round off the week, Fed Chair Jerome Powell will speak and possibly provide some clues as to the Fed’s thinking after the recent slew of economic data.

China has been somewhat overlooked of recent but softening Chinese inflation has brought back concerns around the country’s growth – traditionally a positive relationship with the euro. Regardless of the Chinese government to stimulate the economy, weak data remains and does not bode well for euro bulls.

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

ECONOMIC CALENDAR (GMT+02:00)

Source: Refinitiv

TECHNICAL ANALYSIS

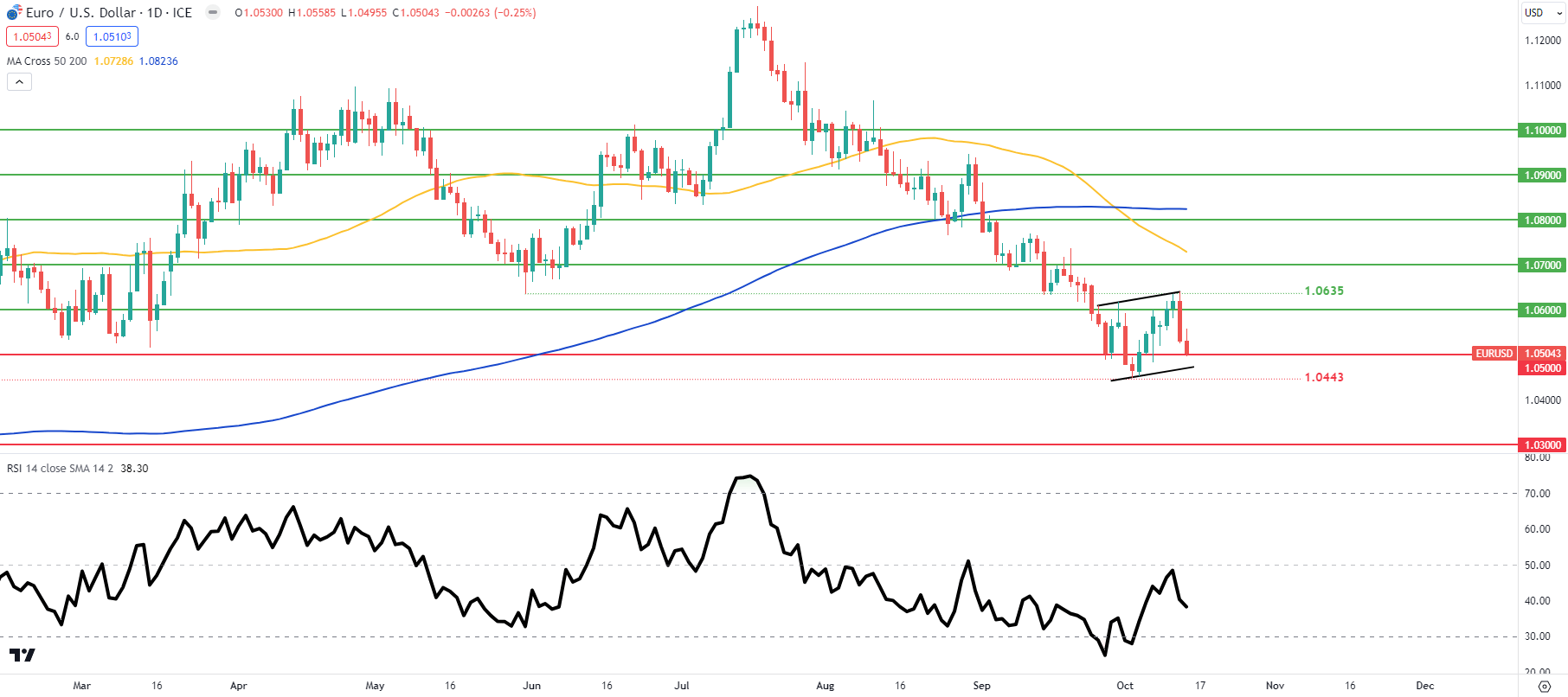

EUR/USD DAILY CHART

Chart prepared by Warren Venketas, IG

The daily EUR/USD chart closed marginally above the 1.0500 psychological handle on Friday and stays within the bearish zone of the Relative Strength Index (RSI). Moving forward it will be difficult to select a directional bias as markets are so easily influenced by the war between Israel-Palestine and any escalation/de-escalation could move the pair in either direction. Traders should exercise caution during this period with sound risk management technique.

Resistance levels:

- 1.0635

- 1.0600

Support levels:

- 1.0500

- 1.0443

- 1.0300

IG CLIENT SENTIMENT DATA: BEARISH

IGCS shows retail traders are currently neither NET LONG on EUR/USD, with 71% of traders currently holding long positions (as of this writing).

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect EUR/USD sentiment and outlook.

Contact and followWarrenon Twitter:@WVenketas

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.