AUD/USD ANALYSIS & TALKING POINTS

- RBA minutes and officials issue hawkish messaging.

- Australian inflation key next week.

- Several bearish technical indications may suggest more AUD pain.

Elevate your trading skills and gain a competitive edge. Get your hands on the Australian dollar Q4 outlook today for exclusive insights into key market catalysts that should be on every trader’s radar.

AUSTRALIAN DOLLAR FUNDAMENTAL BACKDROP

The Australian dollar has received some fundamental backing of recent through a low unemployment rate and some hawkish messaging from the Reserve Bank of Australia (RBA) minutes and officials alike. The fight against inflation seems to be at the forefront of the central bank and many believe that the softening of inflationary pressures is not happening at a fast enough rate. With Australian inflation data scheduled next week (expected lower), this could give a good indication as to where the RBA bias may shift going forward.

US specific data will also come into focus and if the recent resilient data is to continue, the US dollar may continue to gain favor against the AUD. Risk off sentiment via the war in the Middle East has also been a key supporter for the greenback and should tensions remain, AUD/USD could breakdown further.

AUD/USD ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX economic calendar

TECHNICAL ANALYSIS

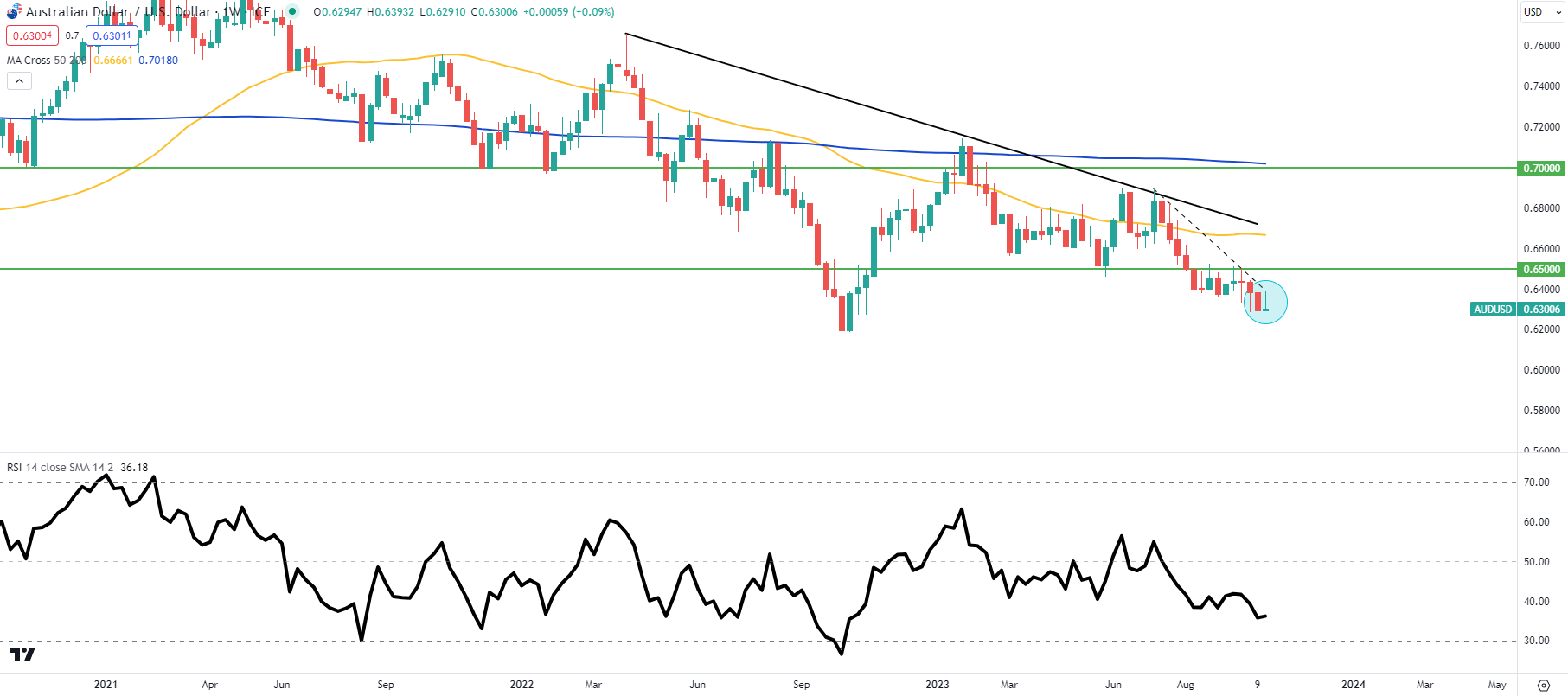

AUD/USD WEEKLY CHART

Chart prepared by Warren Venketas, TradingView

Weekly AUD/USD price action above currently presents a long upper wick weekly candle (blue) and if the week closes in this fashion, the technical suggestion is inclined towards a bearish disposition.

AUD/USD DAILY CHART

Chart prepared by Warren Venketas, TradingView

The shorter-term daily chart shows a downward sloping trendline resistance (dashed black line) zone while support is being held around the October swing low. This support zone is being tested more than once and may be a matter of time before it breaks and opens up the November 2022 swing low (0.6272) resembling a descending triangle. The Relative Strength Index (RSI) also supports a downside bias as current levels trade below the midpoint.

Key resistance levels:

- 0.6500

- 0.6459

- 50-day moving average (yellow)/Trendline resistance

- 0.6358

Key support levels:

- 0.6272

- 0.6170

IG CLIENT SENTIMENT DATA: BEARISH (AUD/USD)

IGCS shows retail traders are currently net LONG on AUD/USD, with 84% of traders currently holding long positions.

Download the latest sentiment guide (below) to see how daily and weekly positional changes affect AUD/USD sentiment and outlook.

Contact and followWarrenon Twitter:@WVenketas

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.