RAND TALKING POINTS & ANALYSIS

- SA inflation data limits rand strength after stellar Chinese GDP print.

- US building permit figures ad Fed guidance under the spotlight later today.

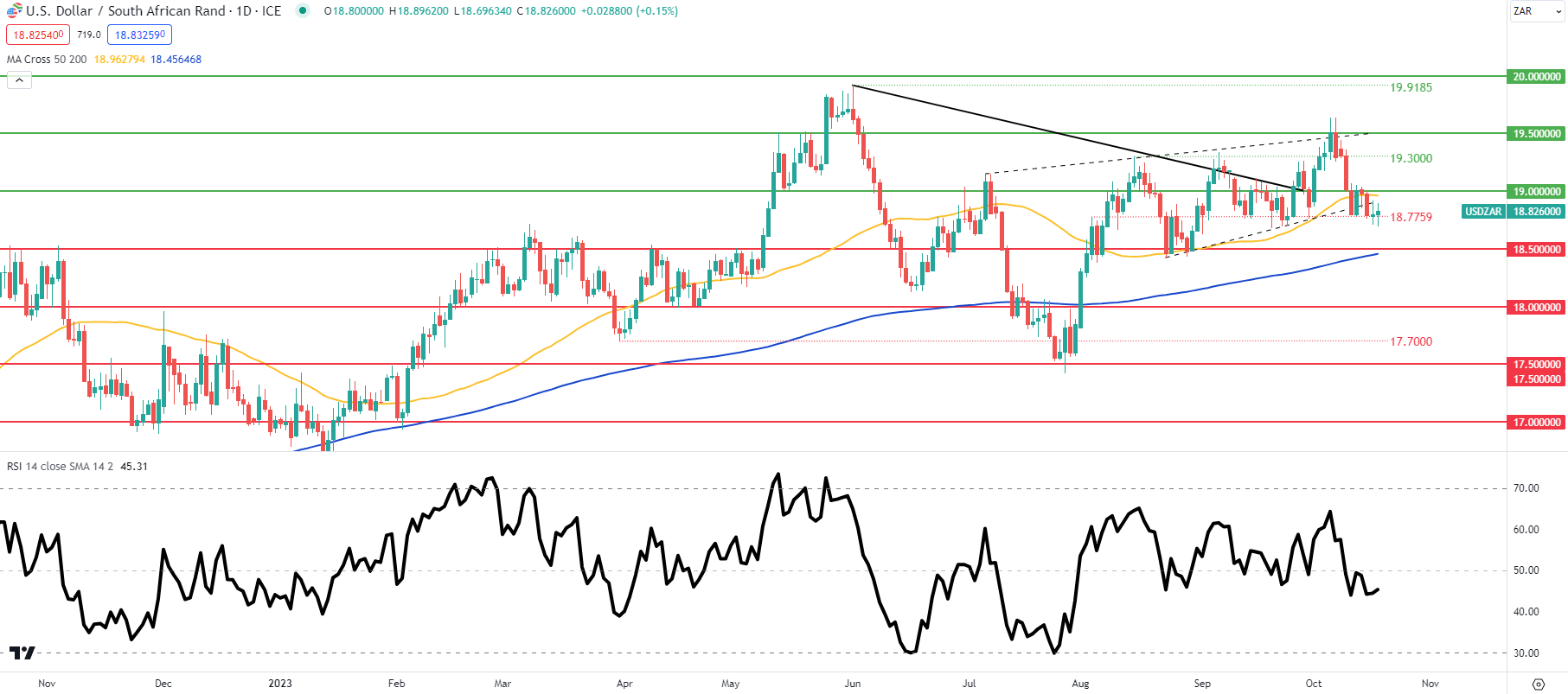

- Rising wedge breakout not completely confirmed yet.

The foundation to financial market fluctuations are generally rooted in fundamental data. Learn more about macroeconomics via our carefully constructed Macro Fundamentals guide – download it now!

USD/ZAR FUNDAMENTAL BACKDROP

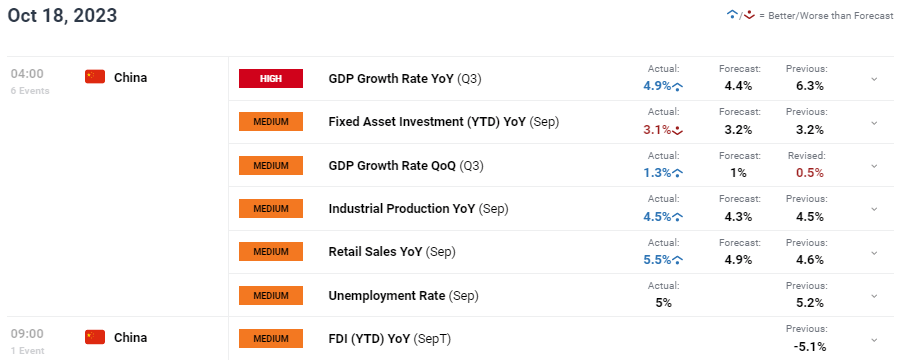

The South African rand is being bombarded by economic data today (see economic calendar below). The Asian session kicked off with an upside surprise beat on Chinese GDP including optimism around industrial production, unemployment and retail sales respectively. After months of weak economic data and stimulus measures by the Chinese government, positively charged momentum is beginning to take shape. Consequently, many commodity prices have rallied leaving demand prospects for South African commodity exports confident.

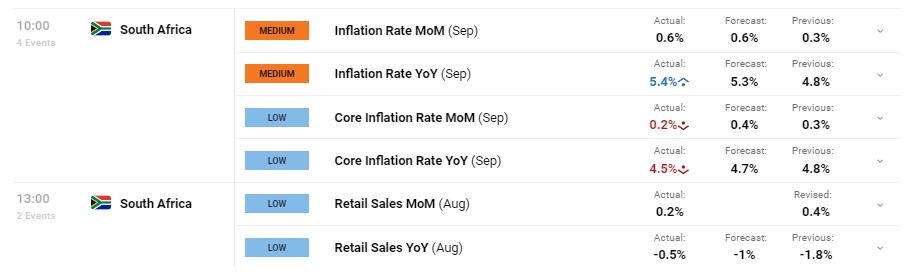

South African CPI was next up on the calendar and showed a significant decline in core inflation which has dovish implications for the South African Reserve Bank (SARB). The ZAR followed by weakening against the greenback but for the consumer, lesser inflationary pressure will be a welcomed outcome. Overall, both the Fed and SARB are likely to keep rates on hold for their next interest rate announcements therefore maintain the carry trade appeal of the rand.

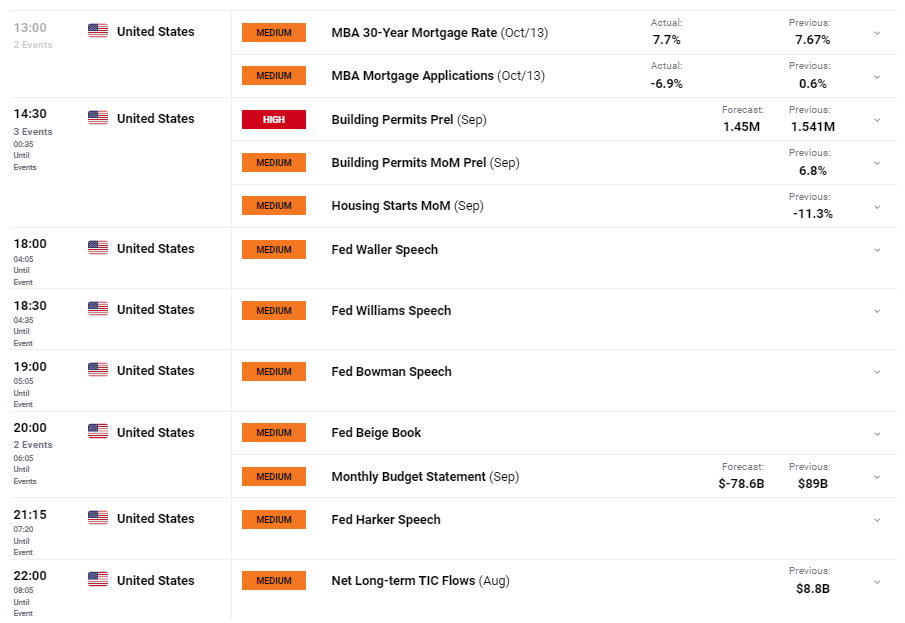

The rest of the trading session will focus on the US via building permit data and a host of Fed speakers ahead of Fed Chair Jerome Powell’s address later this week.

Geopolitics (Israel-Hamas) in the Middle East will continue to play a major role in risk sentiment across global markets and any escalation within the region could weigh negatively on the ZAR in favor of the safe haven US dollar.

USD/ZAR ECONOMIC CALENDAR (GMT +02:00)

Source: DailyFX Economic Calendar

TECHNICAL ANALYSIS

USD/ZAR DAILY CHART

Chart prepared by Warren Venketas, TradingView

Daily USD/ZAR price action shows hesitancy at key support (18.7759) after breaking below rising wedge (dashed black line) resistance. To confirm another breakdown I would be looking for a confirmation close below 18.7759 which could then expose the 18.5000 psychological handle/200-day moving average (blue).

Resistance levels:

- 19.5000/Wedge Resistance

- 19.3000

- 19.0000

- 50-day MA

- Wedge support

Support levels:

- 18.7759

- 18.5000

- 200-day MA

Want to stay updated with the most relevant trading information? Sign up for our bi-weekly newsletter and keep abreast of the latest market moving events!

Contact and followWarrenon Twitter:@WVenketas

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.