Pound Sterling (GBP/USD) Analysis

- UK inflation and jobs data due while average earnings remains uncomfortably high

- USD safe haven appeal cuts GBP/USD relief rally short

- IG sentiment provides mixed outlook despite overwhelming net-long positioning

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

UK Inflation and Jobs Data up Next

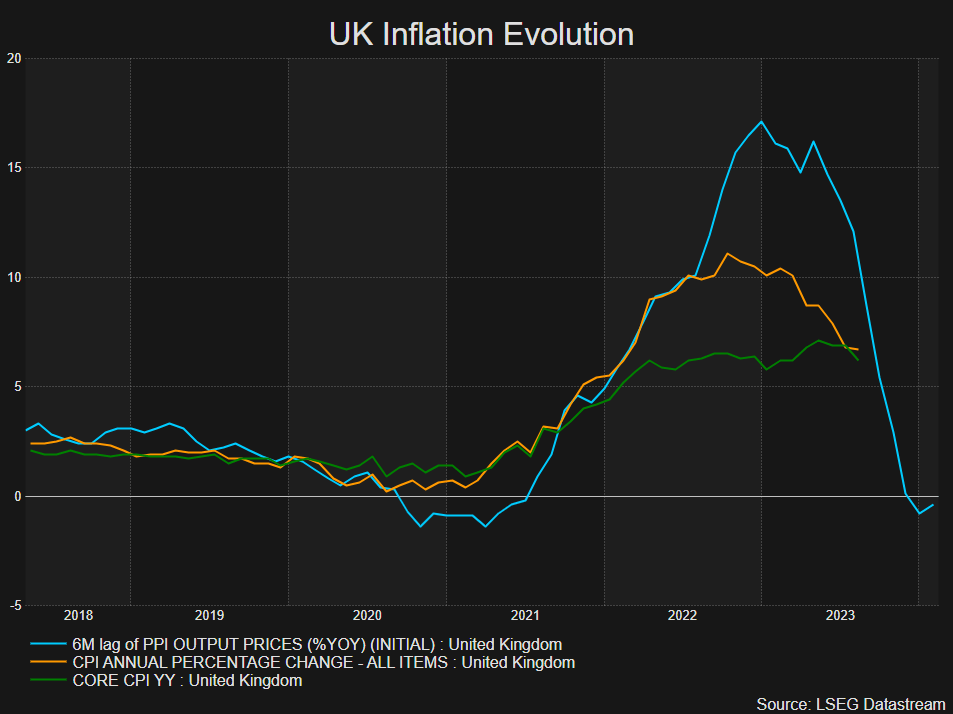

On Wednesday UK inflation data is forecast to see declines for both headline and core inflation but recent surges in oil prices present a risk of an upside beat on the headline measure which includes volatile items like food and fuel.

UK inflation has taken much longer than expected to make a meaningful decline, with the Bank of England saying for much of the year that inflation will experience sizeable moves lower due to base effects and a more stable energy complex.

Another concern for the BoE is the rate at which average earnings are increasing. The most recent data point places the 3-month average earnings (including bonuses) at 8.5% YoY. With the bank signaling an interest rate pause at current levels, officials will be hoping to see further downward momentum in general prices. Some encouraging news has arrived via weaker jobs data, something the bank foresees as playing a part in bringing inflation towards the 2% target.

Source: Refinitiv, prepared by Richard Snow

With central banks approaching or having already reached peak interest rates, will there be any bullish drivers for the pound in the final quarter of the year? Read our Q4 guide to pound sterling below:

USD Safe Haven Appeal Cuts GBP/USD Relief Rally Short

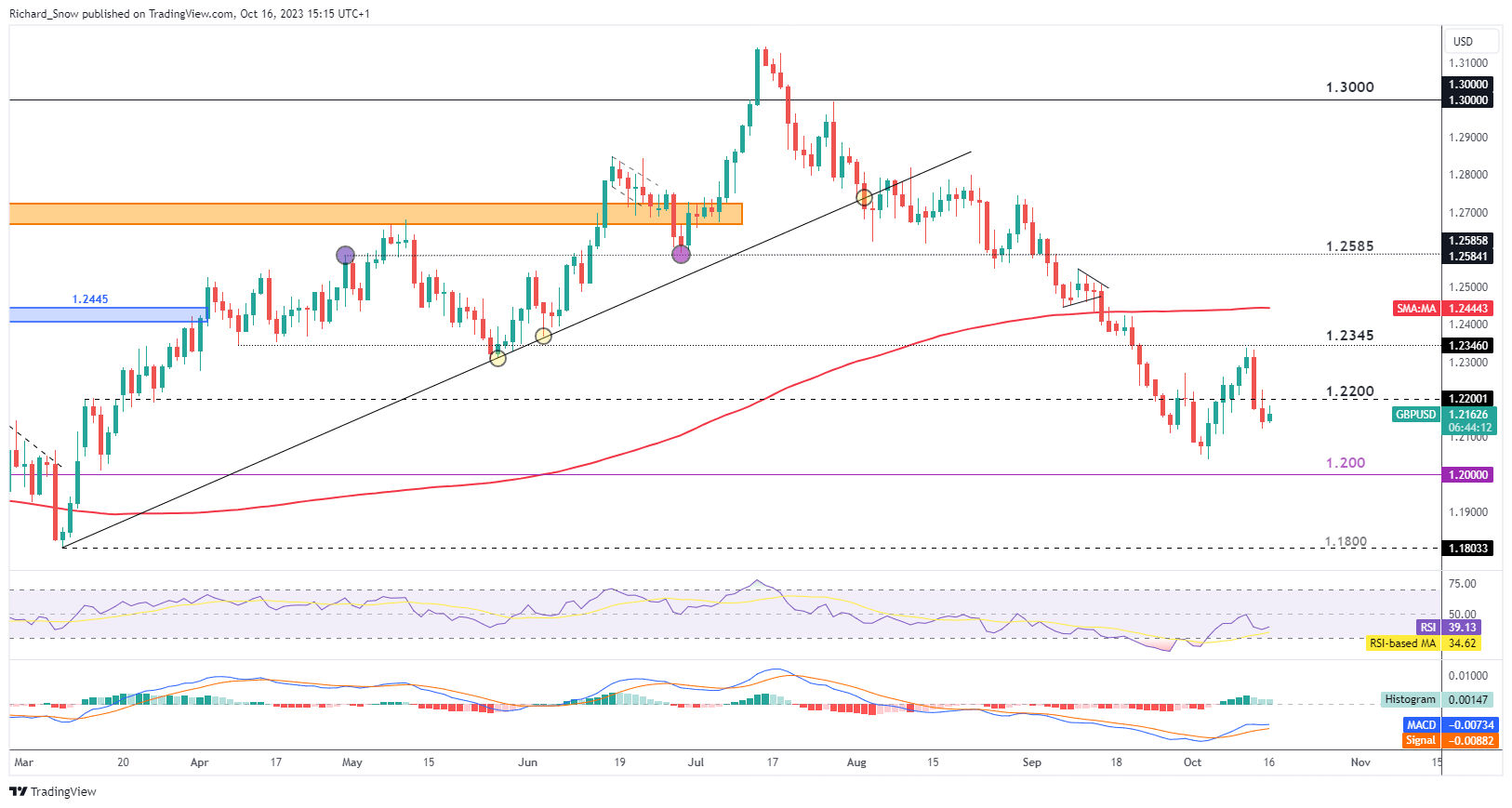

With much of the recent relief rally being driven by the US dollar, could a higher inflation print stimulate an expectation of another rate hike and guide sterling higher? That is the question that remains unanswered as the bar for further movement on rates is a high one considering the meagre economic outlook for the UK.

In addition, the safe-haven appeal surrounding the US dollar means further gains in GBP/USD may be limited. A lower inflation print set up the pair for a continuation of the longer-term downtrend.

The pair trades below the 200-day simple moving average and appears to be retesting the psychological level around 1.2200. Trend traders will be watching for a potential rejection of the level for clues surrounding a bearish continuation. Support resides at the recent swing low, just above 1.2000 flat. Immediate support at 1.2200 followed by 1.2345

GBP/USD Daily Chart

Source: TradingView, prepared by Richard Snow

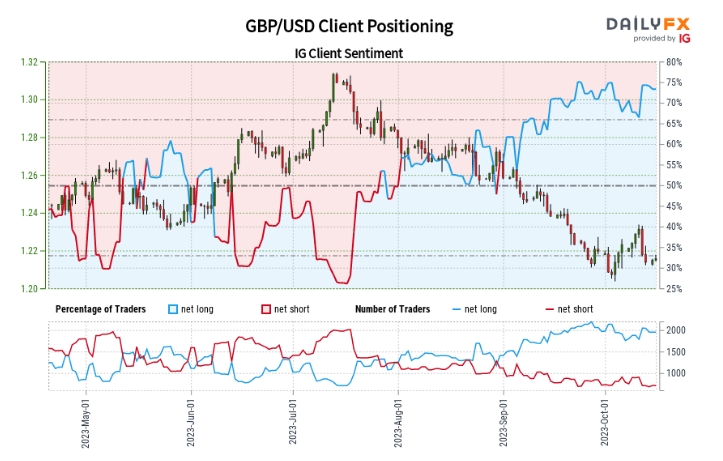

IG Client Sentiment Provides mixed Outlook Despite Overwhelming Positioning

GBP/USD:Retail trader data shows 68.96% of traders are net-long with the ratio of traders long to short at 2.22 to 1.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-long suggests GBP/USD prices may continue to fall.

However, traders are less net-long than yesterday and compared with last week. Recent changes in sentiment warn that the current GBP/USD price trend may soon reverse higher despite the fact traders remain net-long.

GBP IG Client Sentiment Positioning

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.