The Australian Dollar retreated from a 2-week high last week with the US Dollar regaining its ascendency on the back of a hot inflation print in the US. Where to for AUD/USD and AUD/JPY.

Australian Dollar Forecast: Neutral

- The Australian Dollar is caught in the US Dollar vortex for now

- Markets are listening to the Fed speak and responding accordingly

- The RBA are poised but are weeks away from a meeting. Will AUD/USD get pummelled in the meantime?

The Australian Dollar had a whippy week just gone with an initial rally being undone by a runaway US Dollar going into the weekend.

With a dearth of domestic data, the Aussie Dollar moves were left to the machinations of the ‘big dollar’.

Commentary from Federal Reserve officials came thick and fast all week with initial messaging revolving around the higher long end Treasury yields assisting in achieving the desired tightening.

Not long after those initial comments, the bonds rallied and yields plunged. The benchmark 10-year bond nudged 4.88% on Friday the 6th of October, the highest return for the low-risk asset since 2007.

It collapsed during last week to trade below 4.55% but steadied near 4.70% at the close on Friday in the aftermath of headline year-on-year US CPI coming in at 3.7% rather than the 3.6% anticipated.

The bounce back in Treasury yields spurred a USD recovery, sending AUD/USD back toward 63 cents after having looked at nudging 0.6450 in the prior session.

Although there has been a lack of meaningful domestic data, Reserve Bank of Australia (RBA) Assistant Governor Chris Kent made comments last Wednesday highlighting the problems around the time lags in the transmission effect of monetary policy.

He also said, “Some further tightening may be required to ensure that inflation, that is still too high, returns to target.”

Futures markets are pricing in around a 40% probability of a 25 basis point hike by the RBA early next year.

The Australia – China diplomatic relationship appears to be improving with Chinese Ambassador to Australia Xiao Qian making positive overtures ahead of the announcement that Australian journalist Cheng Lei has been allowed to leave China and has returned to Australia.

Australia’s trade surplus continues to run near record levels and an improved relationship with the world’s second-largest economy might boost the nation’s bottom line further.

Looking ahead though, it seems that US Dollar gyrations are likely to dominate AUD/USD movements until Australian third quarter CPI is released on October 25th.

The previous annual reading of 6% is well above the RBA’s mandated target of 2 – 3% and another uncomfortably high print may prompt the RBA into action at their meeting on November 7th.

This Thursday will see unemployment data and it is forecast to remain near multi-generational lows near 3.7%.

Across the ditch, New Zealand will go to the polls this weekend but there is unlikely to be too much impact on markets as there are not any major policy changes being campaigned.

A hung parliament is possible with the NZ First party potentially holding the key to a majority. New Zealanders are familiar with this scenario as it has occurred several times in the past.

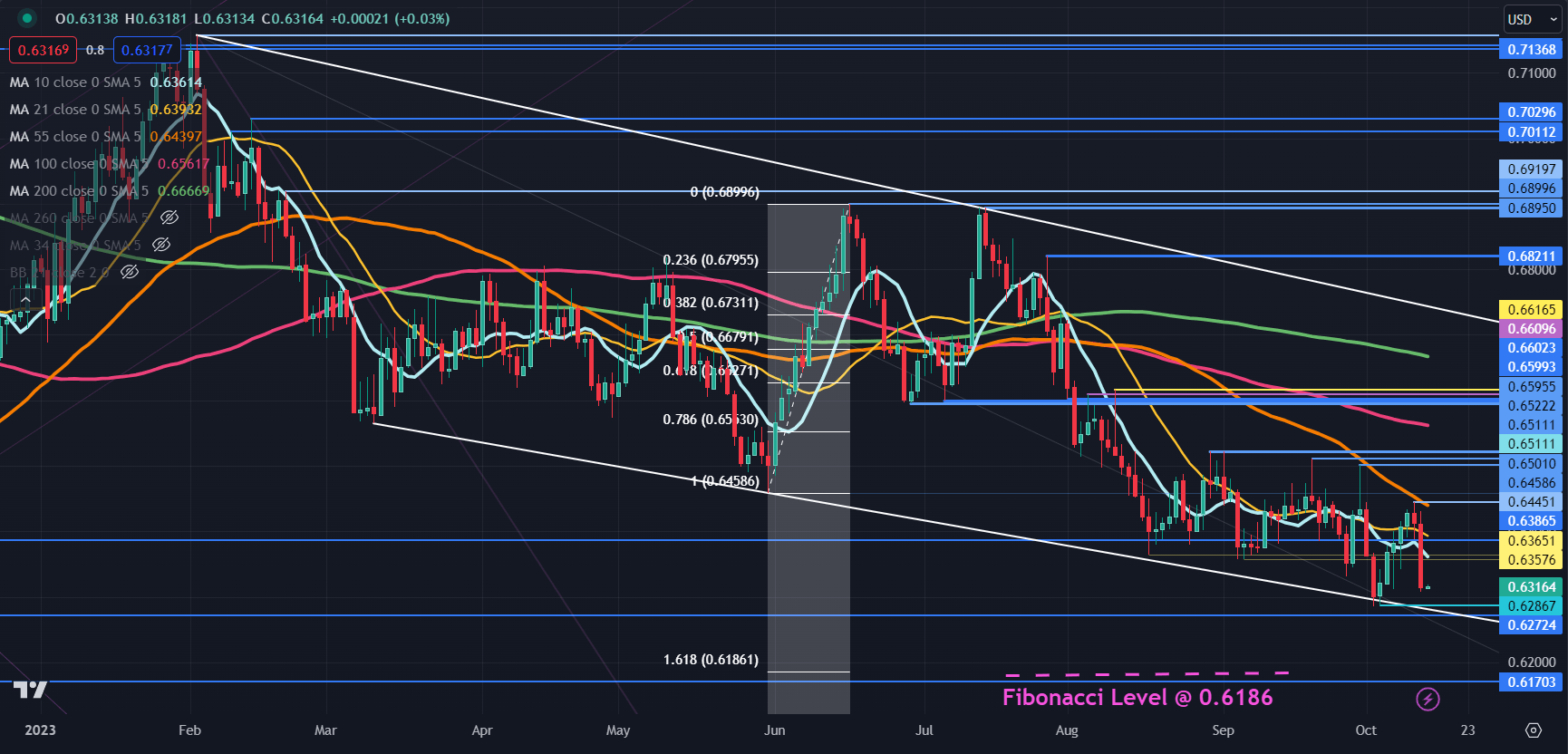

AUD/USD TECHNICAL ANALYSIS

AUD/USD remains in a descending trend channel and bearish momentum might be intact for now.

A bearish triple moving average (TMA) formation requires the price to be below the short-term Simple Moving Average (SMA), the latter to be below the medium-term SMA and the medium-term SMA to be below the long-term SMA. All SMAs also need to have a negative gradient.

When looking at any combination of the 10-, 21-, 55- 100- and 200-day SMAs, the criteria for a bearish TMA have been met and might suggest that bearish momentum is evolving.

To learn more about tend trading, click on the banner below.

Last Wednesday’s high of 0.6447 coincides with the 55-day Simple Moving Average (SMA) and that level may offer resistance ahead of a cluster of prior peaks in the 0.6500 – 0.6510 area.

Further up, the 0.6600 – 0.6620 area might be another resistance zone with several breakpoints and previous highs there.

On the downside, support may lie near the previous lows of 0.6285, 0.6270 and 0.6170.

The latter might also be supported at 161.8% Fibonacci Extension level at 0.6186.

AUD/USD DAILY CHART

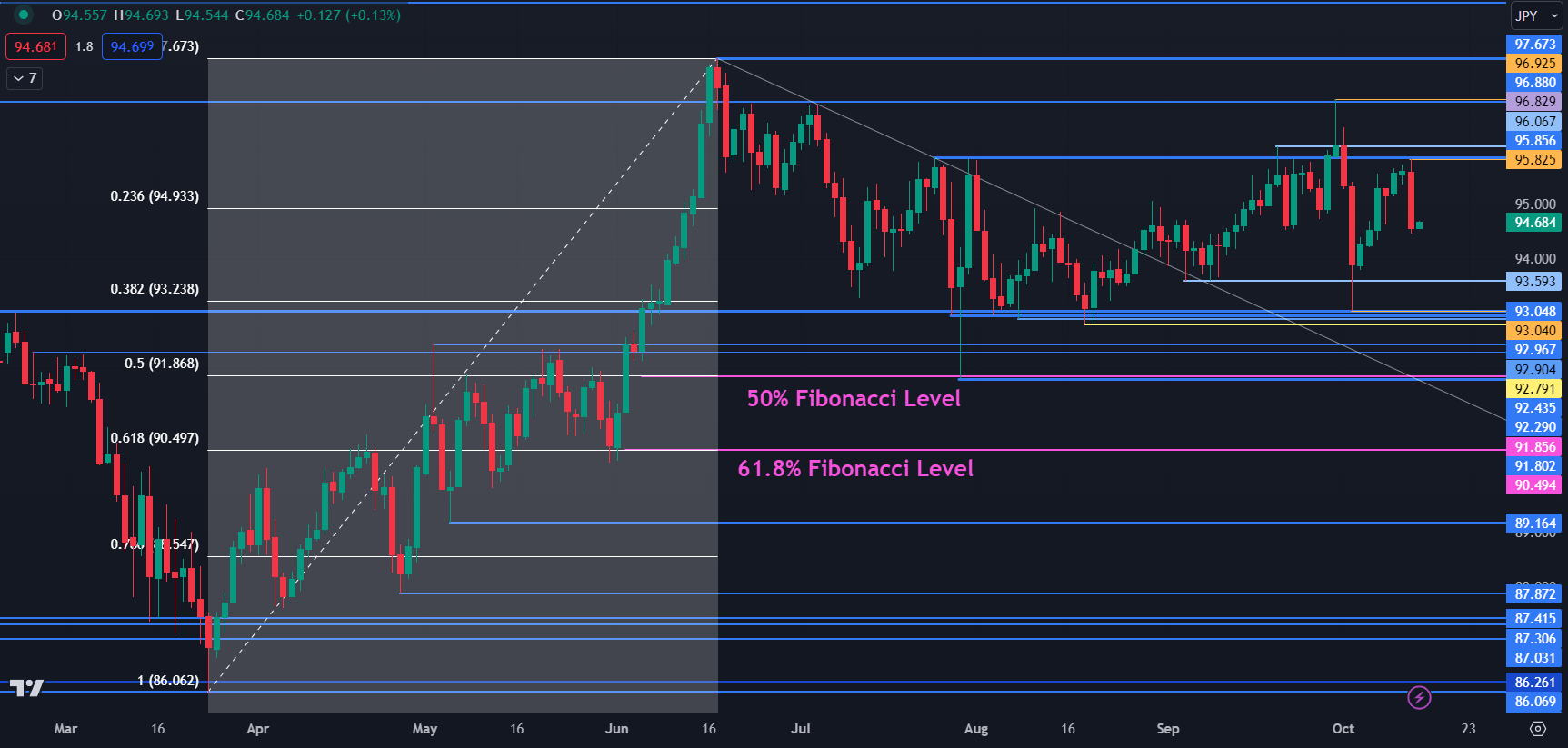

AUD/JPY TECHNICAL ANALYSIS UPDATE

AUD/JPY stalled at breakpoint resistance last week before consolidating back into the recent range. It has mostly traded between 93.00 and 97.00 for four months.

Resistance may remain at the prior peak and breakpoints in the 95.85 – 96.05 area ahead of potential resistance in the 96.80 – 97.00 area.

On the downside, nearby support could be near the breakpoint of 93.59 ahead of the a series of prior lows and breakpoints in the 92.80 – 93.00 possible support zone.

Further down, support may lie at breakpoints of 92.30 and 92.44 ahead of the 50% Fibonacci Retracement level at 91.85 which is near the July low of 91.80.

Support might also be at 61.8% Fibonacci Retracement level at 90.50. To learn more about Fibonacci techniques, click on the banner below.

CTA BANNER NEWSLETTER

— Written by Daniel McCarthy, Strategist for DailyFX.com

Please contact Daniel via @DanMcCarthyFX on Twitter

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.