EUR/USD Forecasts – Prices, Charts, and Analysis

- US dollar may slip lower into the weekend.

- US earnings start in earnest today with a handful of banks on tap.

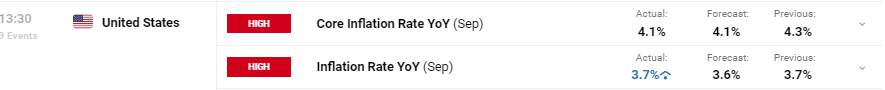

The US dollar rallied by over one big figure yesterday after the latest US inflation data release. Core inflation y/y fell from 4.3% to 4.1% in September, as expected, while headline inflation y/y remained unchanged at 3.7%, one-tenth of a percentage point above market estimates of 3.6%.

Headline US inflation remained unchanged at 3.7% with the shelter costs contributing to around half of the monthly rise while a rise in gasoline prices was also a major contributor to the all items monthly rise. According to the US Bureau of Labor Statistics, ‘while the major energy component indexes were mixed in September, the energy index rose 1.5 percent over the month.’

Core US inflation fell on the month and slipped to its lowest level since September 2021 and has fallen from a peak of 6.6% over the last 14 months.

US Core Inflation

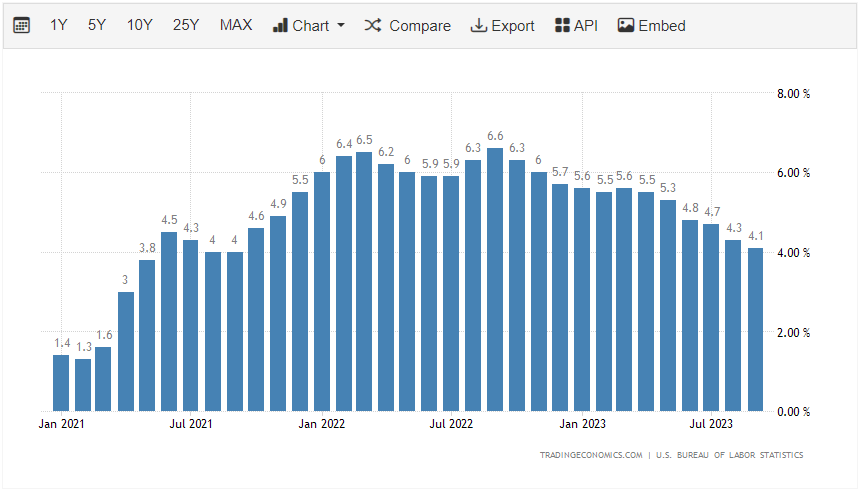

The miss in headline inflation pushed US bond yields higher but future rate hike expectations only moved by a handful of percentage points. The closely followed CME FedWatch tool still suggests that Fed Funds will remain untouched until mid-2024 when the Fed will start cutting interest rates.

CME FedWatch Tool

Our Brand New Q4 Trading Opportunities are Now Available to Download

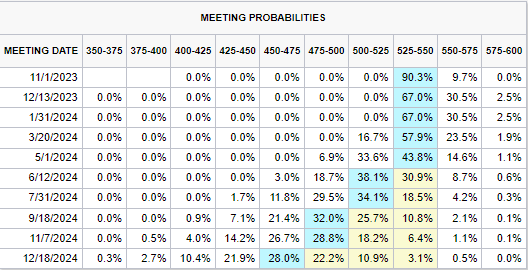

The US dollar had been on the back foot over the week, prior to yesterday’s move, and the likelihood is that Thursday’s move is more a case of overreacting than the belief that the greenback will rally again. One poor data point, a 0.1% miss, does not signal a turnaround in the US dollar’s fortune.

US Dollar Index Daily Price Chart – October 13, 2023

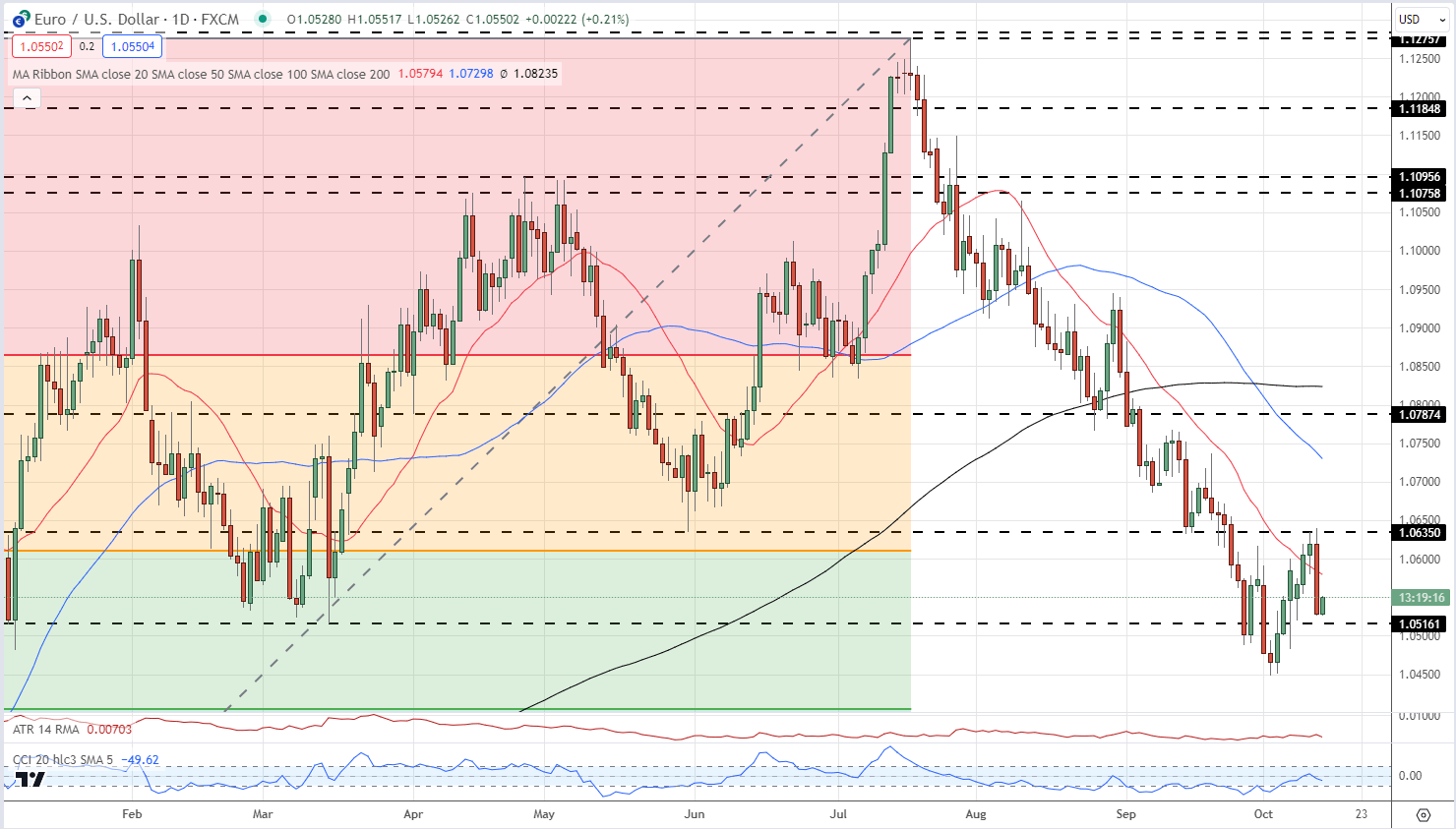

EUR/USD has been a beneficiary of recent US dollar weakness and has twice touched an area of prior resistance we indicated on the daily chart around 1.0635. The pair now trades around 1.0550 and is nearing an old horizontal support level at 1.0516, and this needs to hold otherwise the pair is likely to attempt to break big-figure support at 1.05 again.

EUR/USD Daily Price Chart – October 13, 2023

While the recent US dollar move has provided fx traders with a much-needed boost of volatility, US Q3 earnings start in earnest with a clutch of US banks reporting before the US stock market opens. Today BlackRock (BLK), Citigroup (CITI), JPMorgan Chase (JPM), and Wells Fargo (WFC) open their books and their performance over the last three months may give more of a clue to the health of the US economy. A boost in pre-weekend volatility is likely.

All Charts via TradingView

What is your view on the US Dollar – bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter @nickcawley1.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.