USD/JPY News and Analysis

- Japanese yen unable to build positive momentum despite flight to safety

- USD/JPY heading back towards 150, undeterred by threat of intervention

- The analysis in this article makes use of chart patterns and key support and resistance levels. For more information visit our comprehensive education library

Yen Unable to Build Positive Momentum Despite Flight to Safety

A surprise attack on Israel and the ensuing declaration of war resulted in a flight to safety within financial markets with the Japanese Yen traditionally being one of those safe haven currencies.

However, yesterday’s marginal drop in USD/JPY and the general reluctance of the pair to trend lower despite the recent easing of the US dollar, poses a number of questions around the path of the Japanese currency.

Longer-term US Treasury yields have eased as global investors seek the safety of US Treasuries, removing some of the driving force behind a strong US dollar. Yet despite this, the yen has already surrendered all of yesterday’s gains (at the time of writing) with bullish impetus lacking.

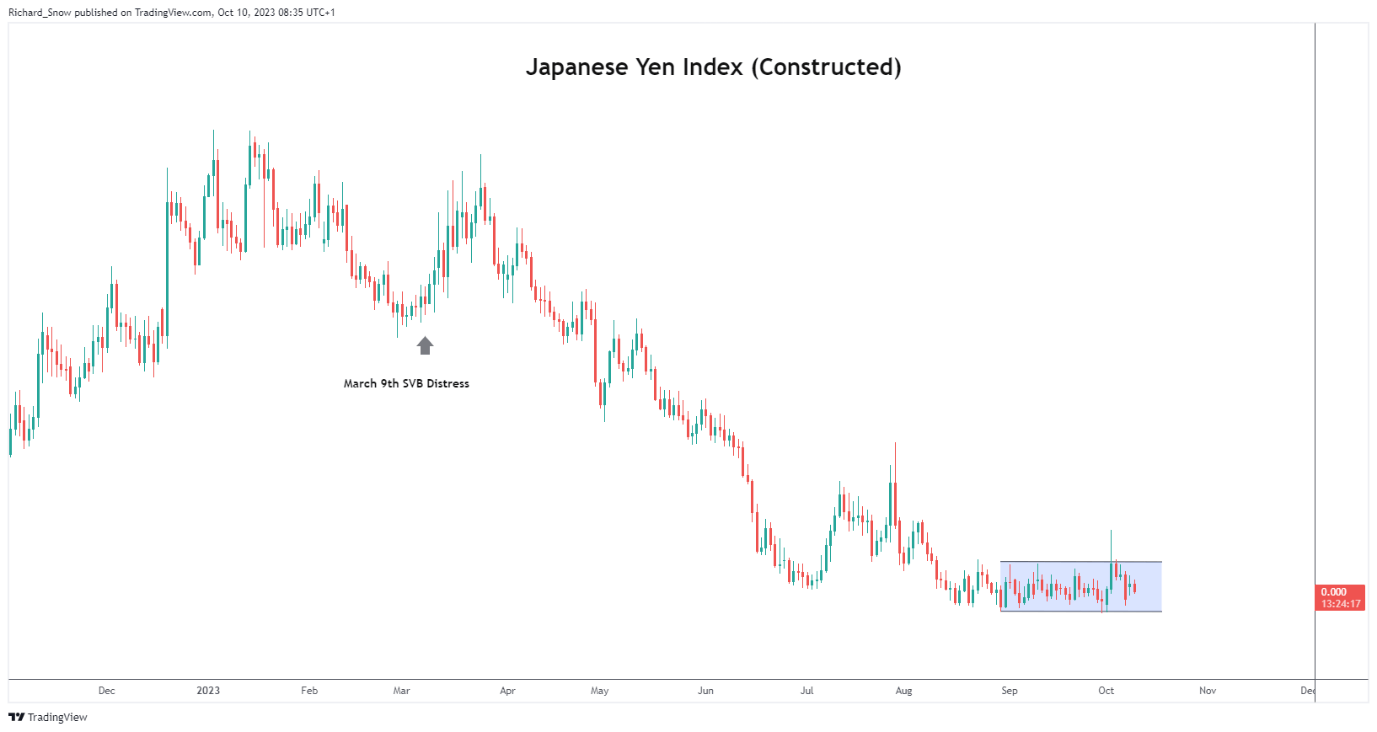

The index below is an equal weighted average of the yen against the US dollar, Aussie dollar, pound and the euro. The yen can be seen consolidating at suppressed levels, breaking above the range briefly on what appeared to be direct intervention in the FX markets by Japanese officials. This is yet to be confirmed. Nevertheless, the yen has not exhibited any of the usual signs of a market on the up.

Constructed Japanese Yen Index

Source: TradingView, prepared by Richard Snow

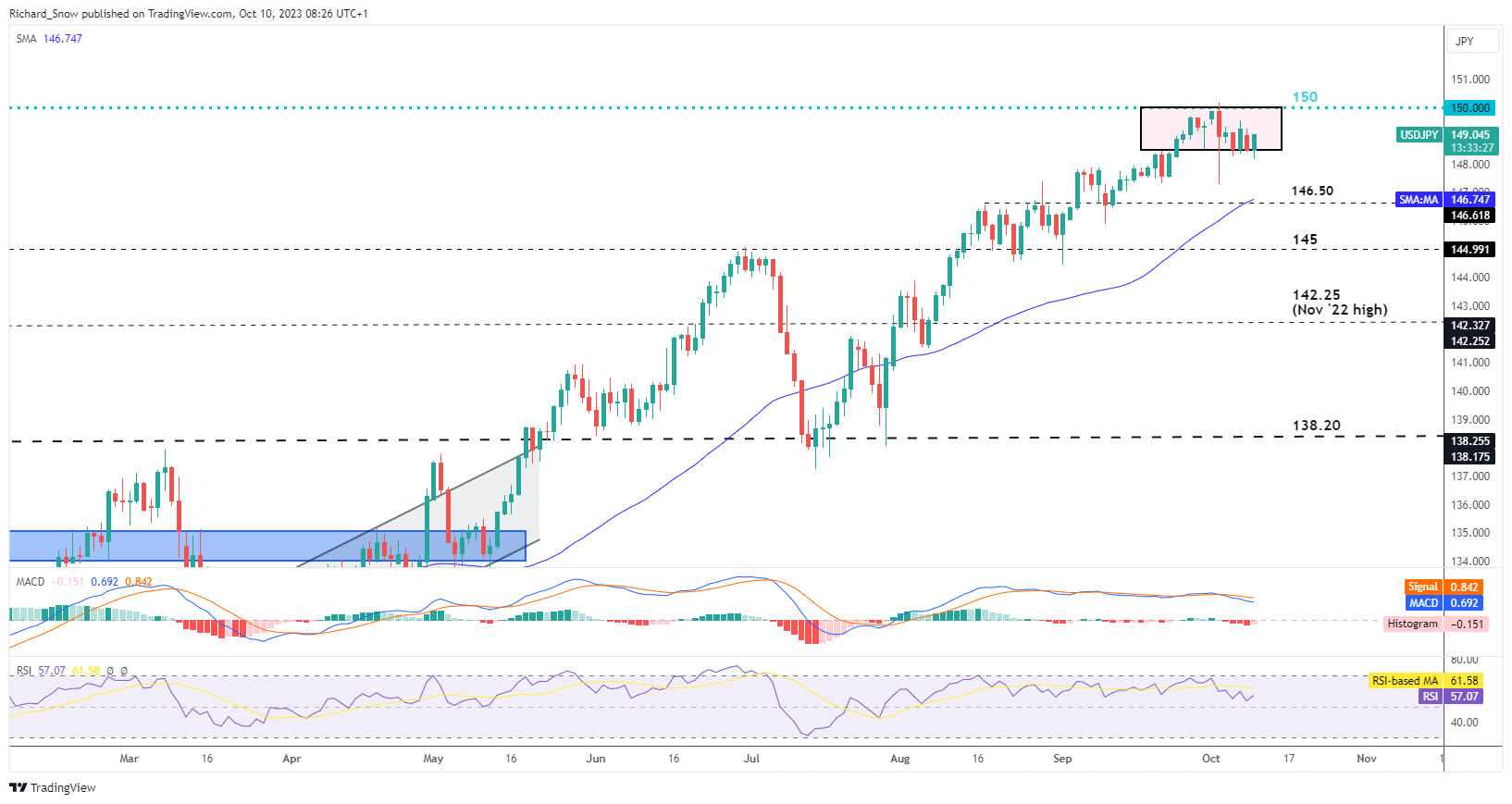

USD/JPY Heading Back Towards 150, Undeterred by Threat of Intervention

USD/JPY appears to have found support (on a closing basis) around 148.50 – the lower bound of the self-identified ‘danger zone’ ahead of 150. It is in this area that prior nervousness can be witnessed as prices gingerly approached 150.

Friday’s blockbuster payroll report – which saw 336k jobs added in September vs 170k anticipated – sent the pair higher. Although, the last 5 days of price action have been clustered without any directional bias.

The RSI failed to rise towards overbought territory, perhaps opening the door to another push towards 150 while the MACD reveals a lack of bullish momentum after the MACD line crossed the signal line.

The risks to new long positions remain extremely high and provides an unappealing risk to reward ratio so near to that 150 level. Should Tokyo run out of patience and intervene in the FX market again, 146.50 becomes a crucial level of support but bear in mind the more immediate level of 148.50. Resistance remains at 150.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

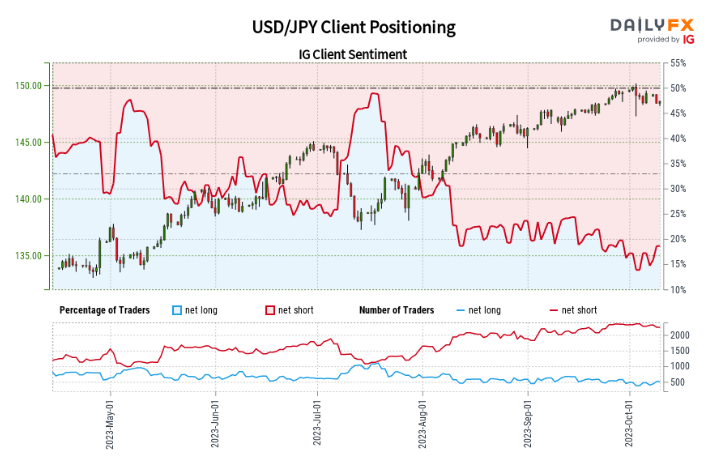

IG client sentiment remains heavily net-short but keep in mind daily and weekly changes as this can influence the outlook. Read more about the intricacies of IG client sentiment and how it can form an instrumental part of your trading process:

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests USD/JPY prices may continue to rise.

Positioning is less net-short than yesterday but more net-short from last week. The combination of current sentiment and recent changes gives us a further mixed USD/JPY trading bias.

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.