DXY, Zillow Rent Index, CPI Shelter – US Dollar Fourth Quarter Fundamental Forecast

- US Dollar supported by rising terminal Fed Funds Rate bets

- CPI Shelter lag ought to pressure core inflation lower ahead

- Will markets continue increasing where the Fed will end up?

US Dollar Third Quarter Recap – Rising Terminal Federal Funds Rate Bets

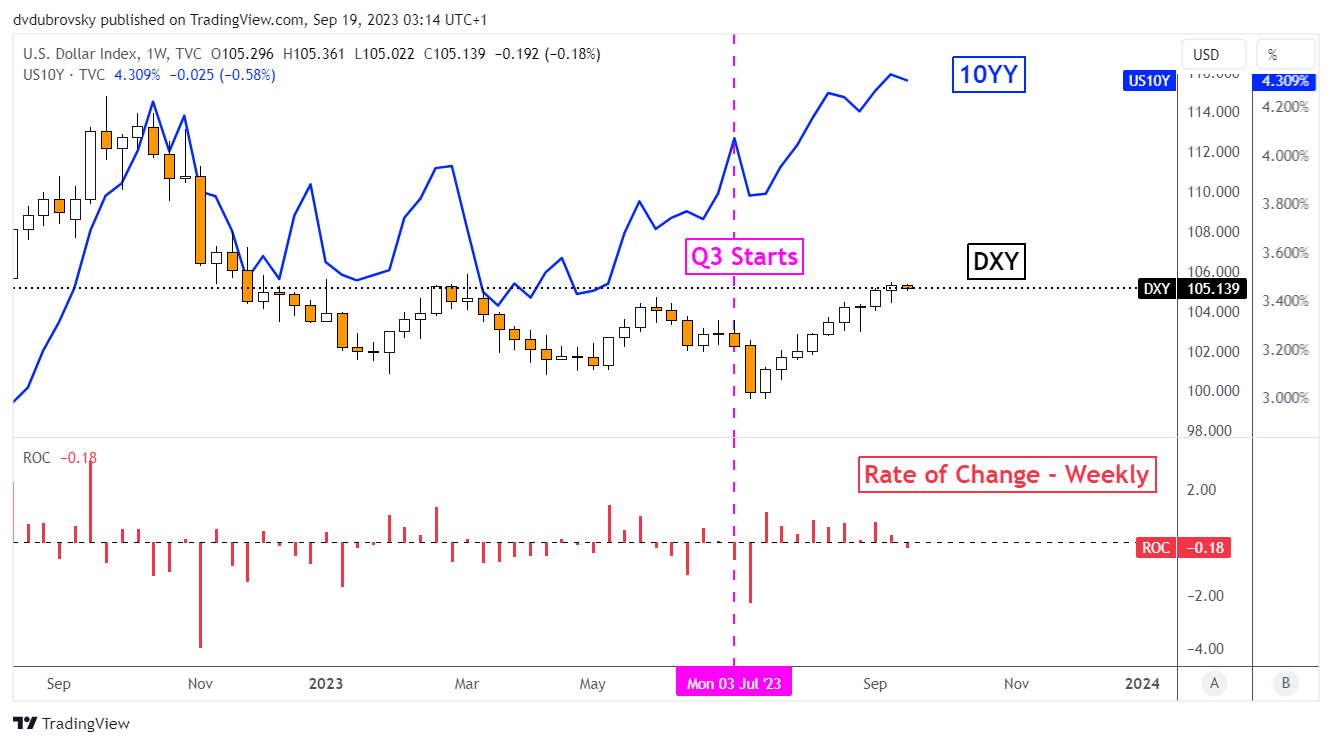

For the most part, the US Dollar aimed higher in the third quarter of 2023. In fact, the DXY Dollar Index rallied for an impressive 9 consecutive weeks, matching performance from 2014. A key driver was the rise in longer-term Treasury yields, influenced by rising expectations of a higher terminal Federal Funds Rate. In other words, tighter for longer. Will the currency continue holding up in the fourth quarter?

DXY Rallies in Q3 Alongside 10-Year Treasury Yields

Chart Created in TradingView

Why You Should Watch CPI Shelter

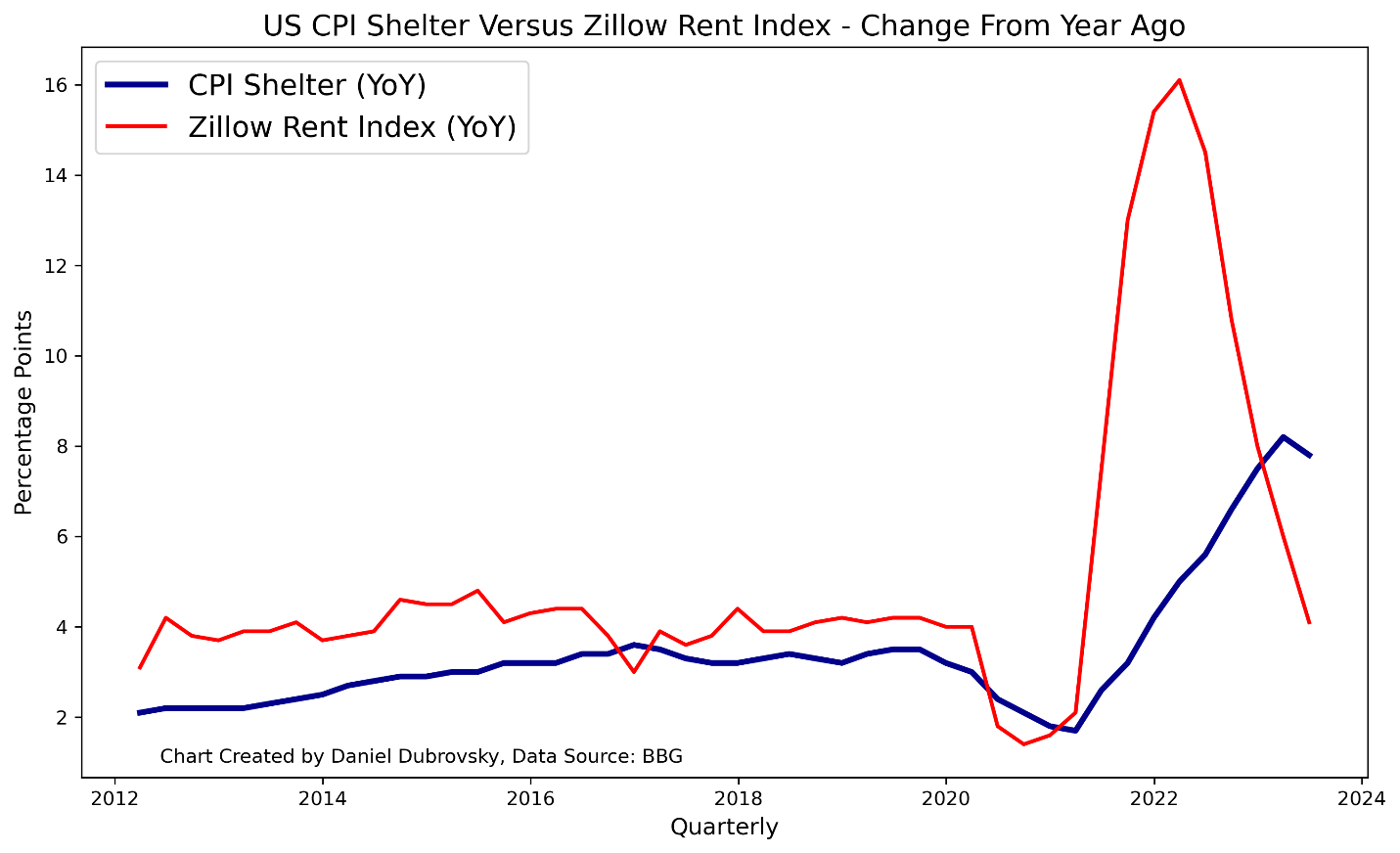

One key fundamental theme that is likely going to influence the Federal Reserve and thus the US Dollar is how inflation will continue shaping up. Below is a chart overlaying the Zillow Rent Index and shelter component of the Consumer Price Index (CPI) – change from a year ago, quarterly data since 2012. As you can see, there is a considerable lag in CPI shelter.

The latter is just starting to dip after months of slowing rent growth. The reason why this matters is because shelter is the largest segment of CPI, meaning it has a key influence on US monetary policy. As such, it will be very important to watch this dynamic as it could have a key impact on where interest rates could end up in the long run.

The Lag Between Zillow Rent and CPI Shelter

Where is Core CPI Going?

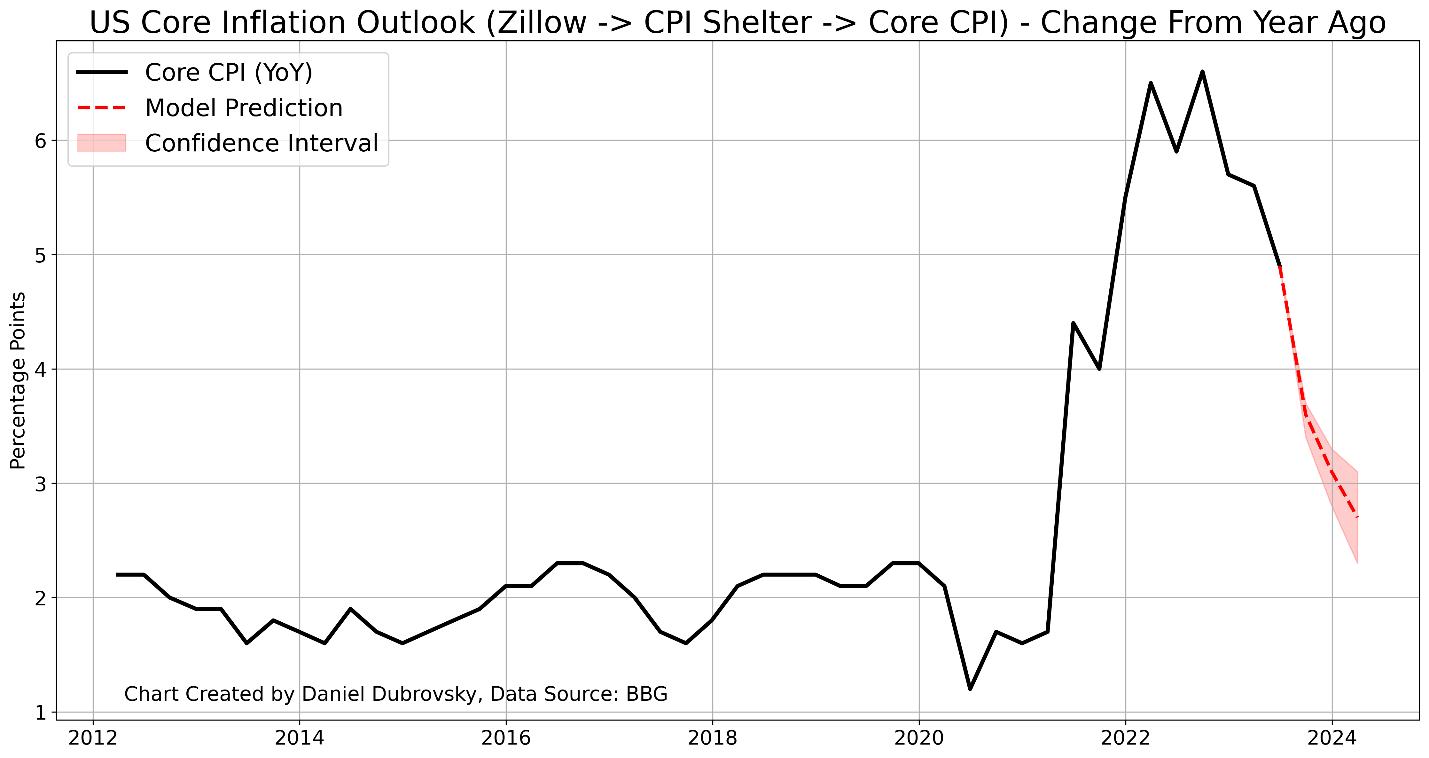

In fact, we can try and use the timelier Zillow data to derive the core inflation outlook in the quarters ahead. Below is a chart showing the estimated trajectory of Core CPI based on the expected effect of the lag in Zillow data driving CPI shelter, which thus heavily influences underlying inflation. Unsurprisingly, the slowdown in rent growth is anticipated to weigh down on underlying price pressures.

This ought to be good news for the Federal Reserve, which is trying to get inflation to come down to target. That said, this is just one component of the various ingredients that are mixed into monetary policy. For example, this does not factor in the recent rise in oil prices, as well as the evolving outlook on the labor market. With that in mind, a Fed that remains on guard could continue supporting the USD.

Using the Lag in Zillow Data to Anticipate Core Inflation in the Future

— Written by Daniel Dubrovsky, Contributing Senior Strategist for DailyFX.com

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.