NATURAL GAS, NG – Outlook:

- Natural gas prices jumped 14% last week – the biggest weekly gain since mid-June.

- Recent drivers include cooler weather, smaller inventory build and higher exports.

- To what extent natural gas can rise and what are the key levels to watch?

Looking for the best trade ideas for Q4? Look no further and download your complimentary guide courtesy of the DailyFX team of Analysts and Strategists.

Natural gas could be set for a material rebound: it rose to an eight-month high last week on higher heating demand, smaller-than-expected inventory build, and rising exports.

Natural gas rose 14% last week, the biggest weekly percentage increase since mid-June. LSEG forecast US gas demand, including exports, would rise in the coming two weeks. On technical charts, natural gas’ break above crucial resistance at the March & August highs of 3.03 has triggered a significant break out from an eight-month-long sideway range.

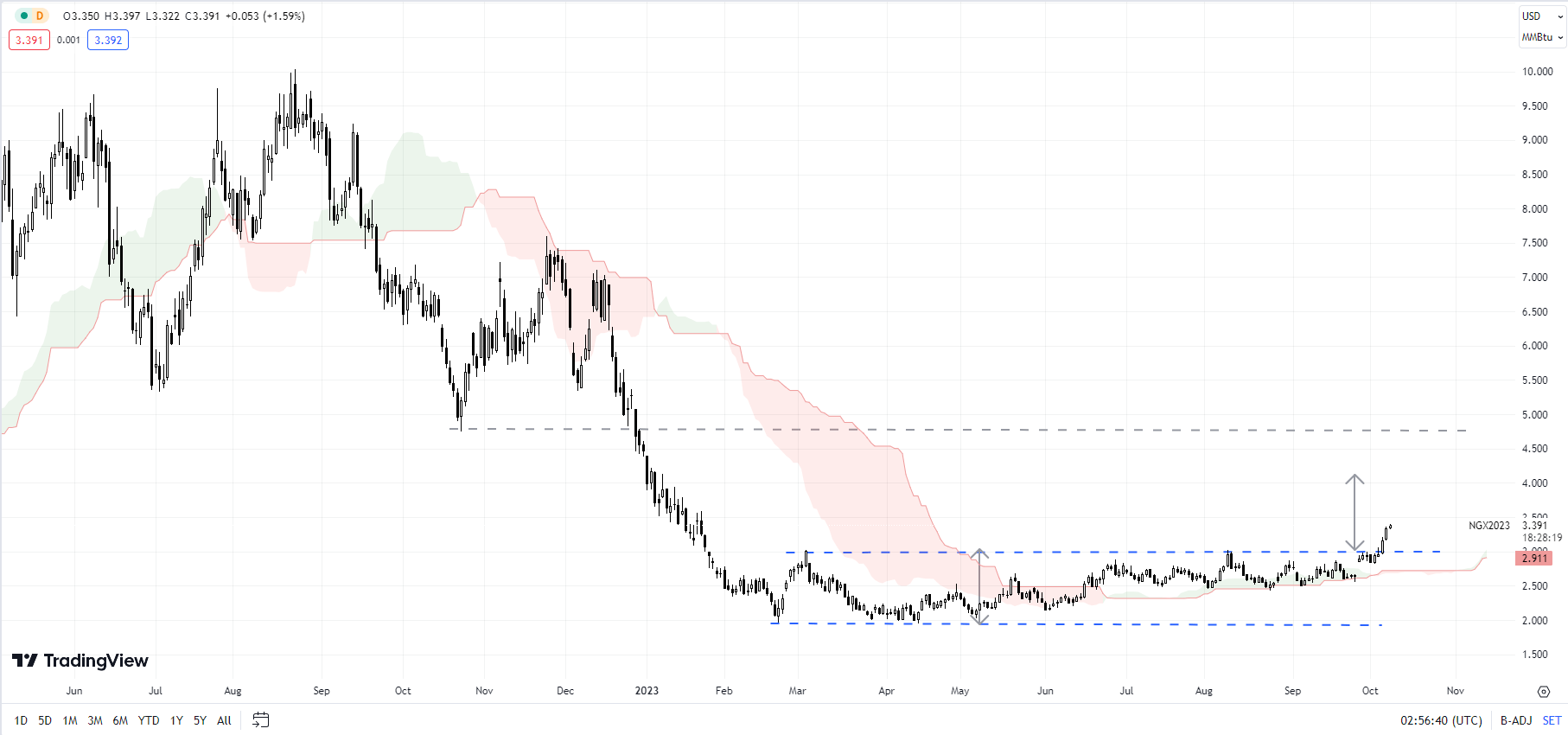

Natural Gas Daily Chart

Chart Created by Manish Jaradi Using TradingView

The price objective of the pattern points to a rise to around 4.00-4.10 in the coming weeks. Last week’s jump was also associated with a rise above the 200-day moving average and a decisive break above the 89-day moving average for the first time this year. Natural gas pulled back in August-September but held fairly strong support on the lower edge of the Ichimoku cloud on the daily charts.

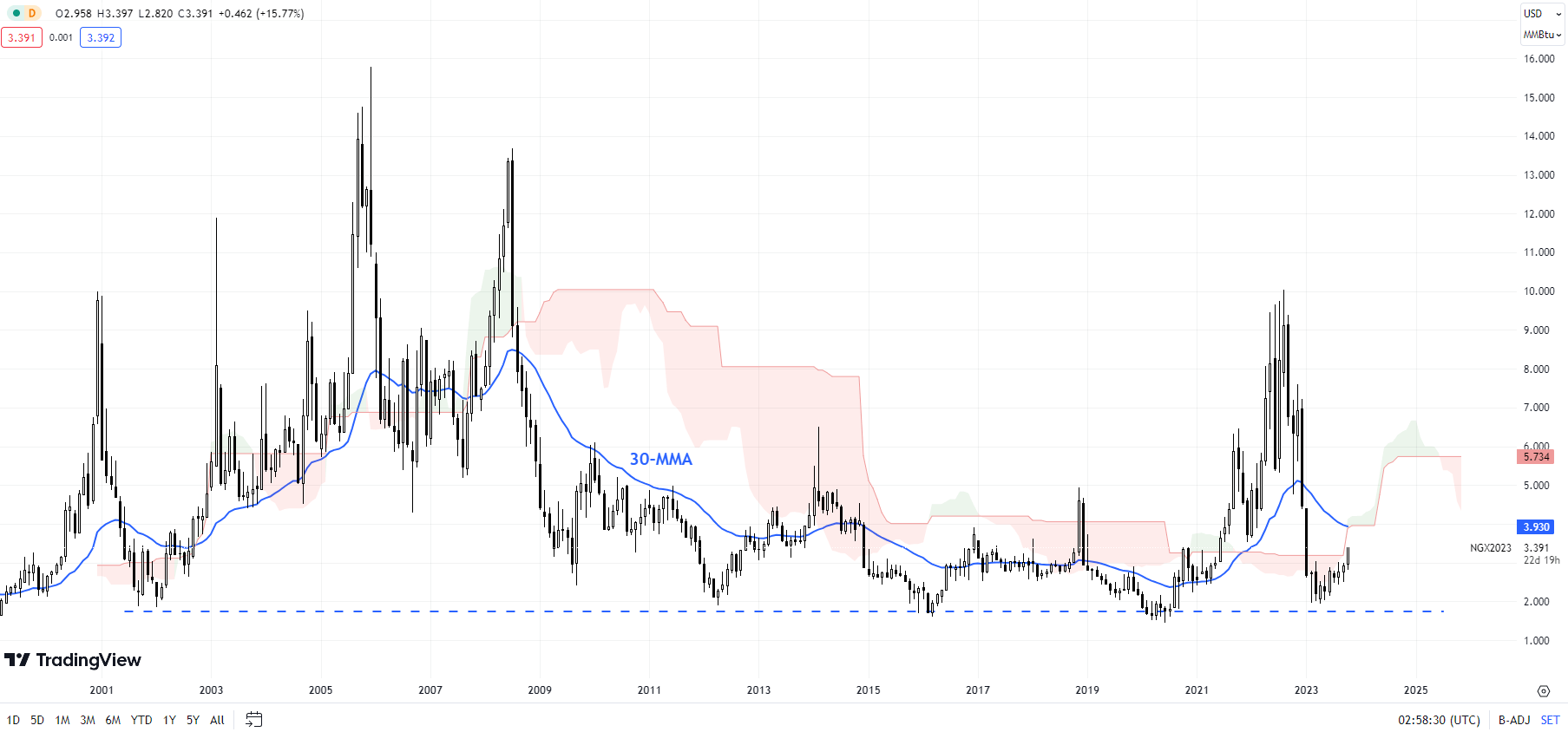

Natural Gas Monthly Chart

Chart Created by Manish Jaradi Using TradingView

Importantly for the first time in 2023, natural gas staged a higher low. Last week’s rise has sealed the higher-high-higher-low sequence in the interim. 30-month moving average, coinciding with the 200-month moving average, around the psychological 4.00 mark. Subsequent resistance is at 4.20 (the 38.2% retracement of the November 2022-February 2023 fall, followed by the October 2022 low of 4.75. On the downside, a fall below the August low of 2.40 would negate the bullish view. Immediate support is at 3.03.

The possibility of natural gas bottoming was first highlighted in early 2023 – see “Natural Gas Price Action Setup: Is the Slide Overdone?”, published February 21, and subsequently “Natural Gas Week Ahead: Base Building May Have Started”, published May 22, and “Natural Gas Price Rebound Could Extend; What’s Next For Crude Oil?”, published May 18.

— Written by Manish Jaradi, Strategist for DailyFX.com

— Contact and follow Jaradi on Twitter: @JaradiManish

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.