Japanese Yen (USD/JPY) Analysis

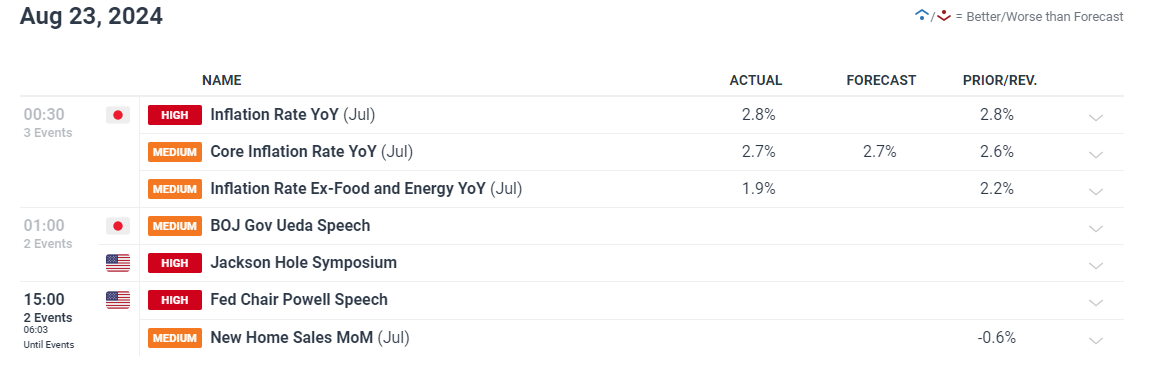

- BoJ encouraged to stick to the plan as inflation continues above target

- Japanese CPI remains at 2.8% – the same as last month and beats estimate of 2.7%

- USD/JPY gains prove short-lived ahead of Powell’s address at Jackson Hole

BoJ Encouraged to Stick to the Plan as Inflation Continues above Target

The Japanese currency strengthened, with the Yen gaining as much as 0.7% against the US dollar, following comments from Bank of Japan (BoJ) Governor Kazuo Ueda suggesting further interest rate increases. This development coincided with a recovery in Asian markets, buoyed by improved performance in Chinese stocks.

In Japan, government bond futures experienced a decline while the Topix index saw gains. Addressing lawmakers, the central bank governor maintained that the BoJ’s stance remained unchanged, provided that inflation and economic data aligned with their projections. These remarks followed reassurances from Ueda’s deputy that future rate hikes would be contingent on market conditions, an attempt to calm investors after the central bank’s July rate increase sparked a significant global equity selloff earlier this month.

Adding to the economic picture, Japan’s inflation data for July exceeded forecasts. The consumer price index showed a 2.8% year-on-year increase, matching the previous month’s figure and surpassing the 2.7% rise predicted by economists.

Customize and filter live economic data via our DailyFX economic calendar

A recent Reuters poll revealed that 57% of surveyed economists expect another rate hike from the BoJ before the end of the year, with those voting for the increase seeing this most likely in December.

With the interest rate differential narrowing, albeit slowly, markets have already started to cover large carry trades that sought to take advantage of cheap money at a time when yen interest rates were in negative territory. The trend is likely to continue as long as inflation and wage growth unfold as anticipated by the BoJ. Higher interest rates in Japan contrast the market’s expectations around incoming rate cuts from the Federal Reserve Bank, likely starting in September.

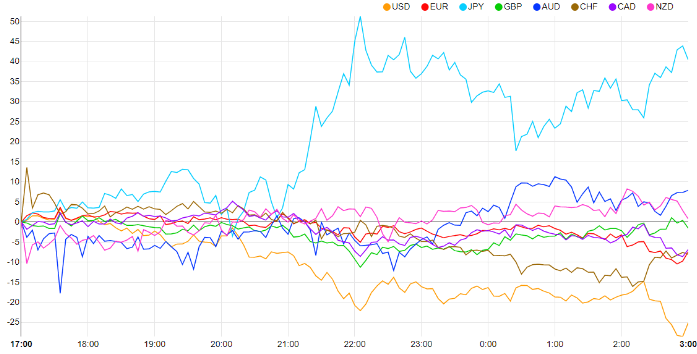

Intra-day Currency Performance

Source: FinancialJuice, prepared by Richard Snow

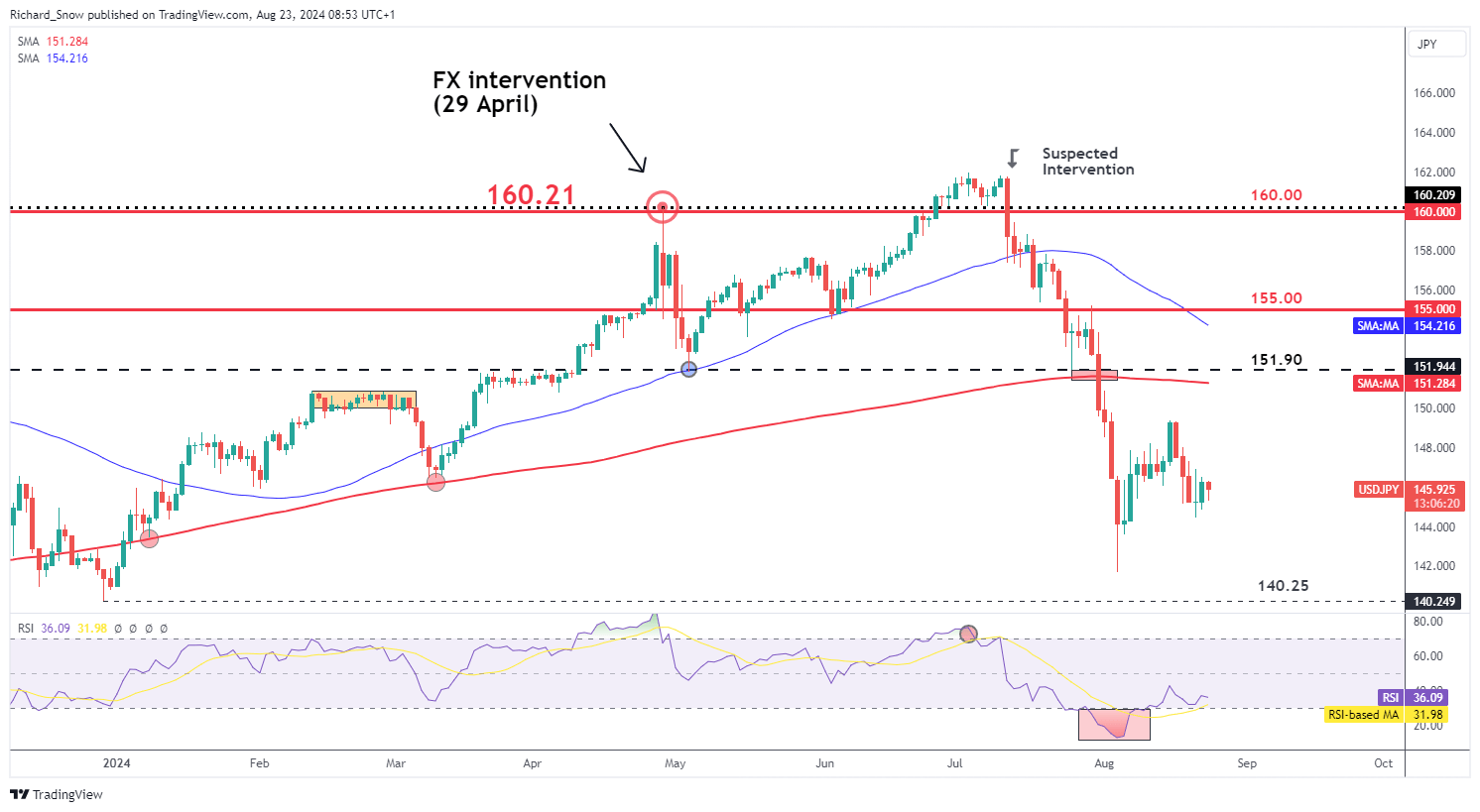

USD/JPY Witnesses a Modest Decline Ahead of Jackson Hole Event

USD/JPY trades a tad lower ahead of Jerome Powell’s Jackson Hole address on the economic outlook. He and other prominent central bankers will provide their insights on current conditions and monetary policy in general.

Given we have already perused the FOMC minutes from July where the majority of the committee agreed that a rate cut in September is appropriate, there could be very little new information being shared today. Under such a scenario it wouldn’t be unusual to see the dollar breathe a sigh of relief and trade a little higher heading into the weekend.

The pair has attempted a pullback after the massive downtrend, which culminated after a softer US CPI print encouraged Japanese officials to intervene in the FX market to strengthen the yen. USD/JPY now trades lower while markets attempt to assess the next move. If the Fed adopt a bearish outlook while the BoJ continue to move forward with one more rate hike in December, it is possible there will be further weakness heading into the end of the year. Support lies at the spike low of 141.70, followed by 140.25 – a prior swing low from December last year. Resistance lies at the recent swing high of 149.40.

USD/JPY Daily Chart

Source: TradingView, prepared by Richard Snow

— Written by Richard Snow for DailyFX.com

Contact and follow Richard on Twitter: @RichardSnowFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.