British Pound Weekly Forecast

- GBP/USD has had its strongest month since November

- EUR/GBP had also weakened sharply

- Neither trend needs to reverse, but there’s not much UK focus in the coming week’s data

British Pound Forecast: Neutral

May was the British Pound’s strongest month against the United States Dollar this year as uncertainty as to when the Bank of England might cut interest rates keeps a solid floor under Sterling. The coming week offers little clear reason to reverse this trend, but there is no obvious clue that current trading ranges might break.

Inflation in the United Kingdom came in at a near-three-year low at last look, with a 2.3% annualized gain booked for March. While this might not initially seem terribly supportive for the Pound, the details were clearly more so. Service-sector pricing remains much stronger than the headline, and that headline itself was stronger than expected, if not by much. Moreover, wage settlements are also stickily high, and house prices have resumed their uptrend.

All up, while inflation looks to be headed in the direction the BoE wants, markets don’t think it’s doing so fast enough to permit many rate reductions this year. Only one, quarter-point rate cut is now fully priced into Sterling forward curves.

To some extent, the UK central bank has the same problem haunting the Federal Reserve and the European Central Bank. The latter will command global market attention in the coming week, with its June monetary policy decision coming up on Thursday. It is expected to be the first major authority to reduce rates and to do so this week. If it does, EUR/GBP could fall further although it has come down quite steadily this month already.

The week is not full of likely scheduled Sterling trading cues beyond the ECB decision and the press conference to follow it. There’s no first-tier UK data on tap and the BoE won’t be making its own interest rate call until June 20. With that in mind, it seems likely that the Pound will remain in a holding pattern, so it’s a neutral call this week.

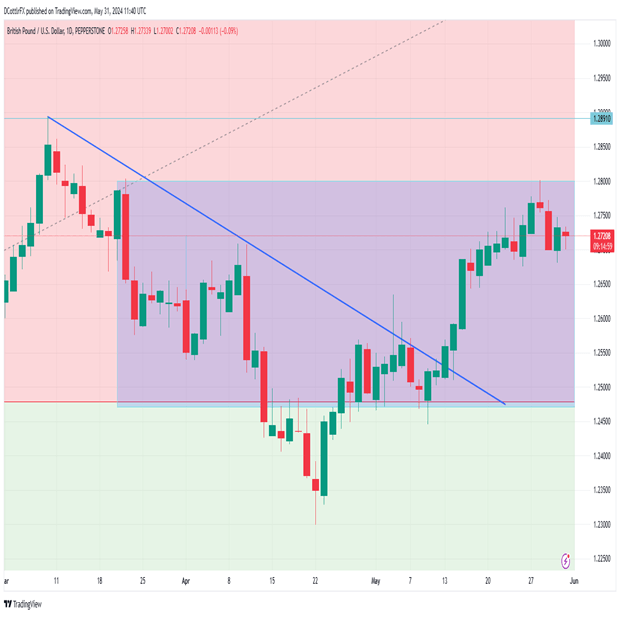

GBPUSD Technical Analysis

GBP/USD Daily Chart Compiled Using TradingView

GBP/USD has risen sharply and consistently since the missile of April, but the bulls’ appetite seems to run out when it nears the peak of March 20, around 1.27979. That now forms the broad range top, a test of which was attempted and rejected on May 28.

The Pound will need to build a durable base above that if it’s going to push on further to the significant, seven-month peak of March at 1.28893.

Reversals will find near-term support in the 1.2670 region where the market has bounced in the last couple of weeks, with psychological support at 1.2600 in place ahead of the range base. That is found at retracement support of 1.24788. That latter level looks pretty safe at present.

The 200-day moving average for GBP/USD remains quite a long way below the current market, way down at 1.25379, but well within the current broad range. IG’s own data finds trading sentiment broadly balanced, with a modest bearish bias.

This appears to reflect fundamental uncertainties around the pair quite well and also suggests that a neutral stance is probably appropriate as a new month gets under way.

–By David Cottle for DailyFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.